Most businesses don’t exactly know whether they need to manage their inventory smartly. And once they figure that out, they get stuck in a dilemma of whether they should adopt a perpetual inventory system, periodic inventory system, ABC analysis, Just in time, FIFO, LIFO, EOQ, two bin control, dropshipping, cycle counting, fast- and slow moving inventory, etc.

If you want to know about Perpetual Inventory Methods, read on –

Perpetual Inventory System

It’s always about time; time plays a vital role in today’s world—you lose time, you lose money. To be precise, you lose money on inventory. The business owners and warehouse managers soon identified this, and therefore they wanted an inventory management method that helped them to make instantaneous changes in their inventory levels.

As a result, in the quest to find a more proactive way to manage stocks and register the additions and subtractions in stocks, one of the many methods of inventory management, the perpetual inventory system—one of the most modern and effective ways of managing your inventory—was made possible in the early 1970s with the use of digital computers.

What exactly is the Perpetual Inventory System?

The perpetual inventory method of accounting for inventory, as the name suggests, is about tracking inventory ‘perpetually’ as it moves throughout the supply chain. In this approach, warehouse managers keep a continuous track of inventory balances, which means the stock is updated automatically every time an item is received or sold through every point of sale.

The president of Max Muller & Associates LLC and Author of “Essentials of Inventory Management,” Max Muller says,

“Perpetual inventory systems keep track in real-time. It uses software to follow the rules and keep the system up-to-date, and it works great. I recommend doing 3D counting, where you count cross-sections often enough to account for the whole over time. You could consider this perpetual, but it would need to be software-driven and follow the rules or do a variation.”

In the perpetual inventory system, purchases and returns are also recorded automatically in the inventory count.

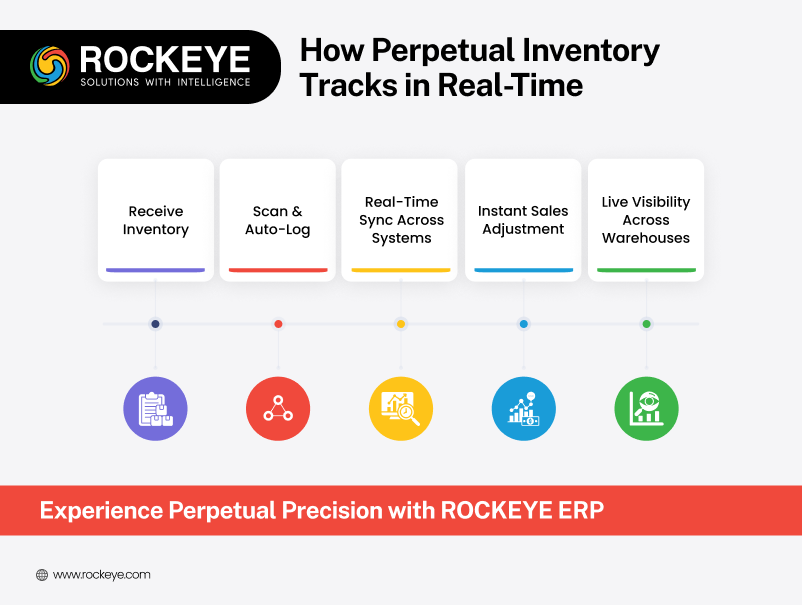

Perpetual inventory systems utilize barcode scanning, radio frequency identification (RFID) scanners, and inventory management software integrated with POSs, CRMs, marketplaces like Amazon FBA, and purchase, order, and return management software to track inventory in real-time.

This ability of modern cloud-based inventory management software to get integrated with all the systems makes the perpetual inventory system more practical. It empowers businesses to speed up their financial and accounting matters. Inventory being an essential asset to the companies, the perpetual inventory system also enables the accounting teams to create more accurate tax and regulatory reports.

Perpetual inventory formula

Beginning inventory (usually from a physical count) + receipts – shipments = Ending inventory

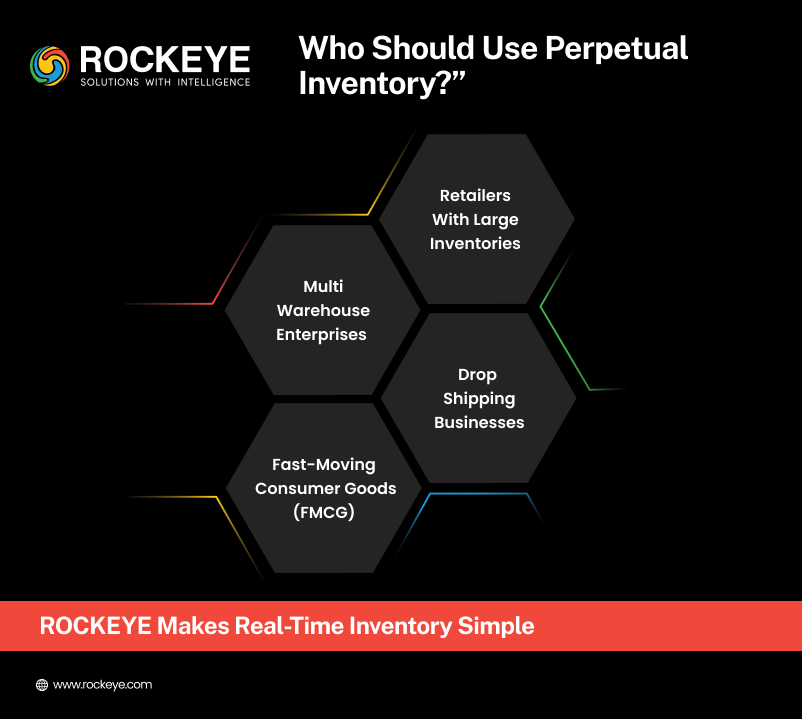

What Types of Businesses Should Use Perpetual Inventory Method

Huge businesses with multiple warehouses and large amounts of inventory generally resort to the perpetual inventory method. However, SMBs looking to grow quickly also can adopt this method to track inventory.

Physically counting inventory or carrying out cycle counts frequently is almost next to impossible for a large-scale industry with thousands and lakhs of SKUs. Hence perpetual inventory tracking is the most apt inventory management method.

For instance, let’s assume you have a business of t-shirts and jackets. You keep your inventory distributed in 8 warehouses. One day you get an order for a woolen coat that has been very rarely asked for, and it’s the summer season.

What are you going to do? Well, if you are managing your inventory perpetually, all you have to do is just sit and chill because the warehouse having that jacket will get the notification about the order. They would do the rest of the job. It’s as simple as that since the systems are connected, and new data is flowing to each warehouse manager through an interlinked system.

But if you have a periodic inventory system, you will have to call your warehouses and tell them to find that jacket and ship it. It would take more time and cause problems.

Another type of business that requires the perpetual inventory method is dropshipping companies. Their products move from the manufacturer or supplier to customers all the time, and there are returns and exchanges. Their inventory is always moving, and to know which product is in stock and which one is not, they need to track the flow of inventory perpetually.

How a Perpetual Inventory Method Works

Whenever there is a sale of a product, the inventory management system attached to POS immediately applies the debit to the main inventory across all channels if all the channels are well connected.

Similarly, whenever products are coming into the inventory, the workers can scan those products’ barcodes with RFID scanners, and the inventory count gets updated instantaneously.

As soon as the change is applied, the inventory on hand changes, which allows you to be well aware of your stock levels. Unlike the periodic inventory method, you can calculate the cost of goods sold frequently as the changes in the inventory.

However, even in the perpetual inventory system, you will sometimes need to count stock to make sure that the virtual stock count aligns with the real inventory whenever there are discrepancies in the on-hand stocks in real life.

As far as accounting is concerned, the perpetual inventory calculations are based on three parameters:

- Real-time changes in the inventory

- Changes due to discards or depreciation in inventory

- Theft or shrinkage in the inventory

Although real-time data is the most noted parameter in the perpetual inventory system method, alterations in the inventory due to discarding, depreciation, and theft or shrinkage are often adjusted manually in the end while accounting.

Formulas in Perpetual Inventory Method

Mathematical formulas are always helpful to make accurate decisions related to ordering new inventory like when to order, how much to order, how much lead time is needed, and what amount of stock should be allocated to be kept as safety stock.

EOQ Model

The Economic Order Quantity (EOQ) model is used to determine the amount of inventory to buy to meet the demand and reduce increasing inventory holding costs. Perpetual inventory accounting helps you to know your inventory flow, with the help of which you will be able to calculate EOQ easily.

EOQ = sqrt((2ds)/h)

Where,

d = Demands in unit per year

s = order cost per purchase

h = holding cost per unit per year

The Cost of Goods Sold (COGS)

In the perpetual inventory method, the COGS is also calculated perpetually. As the product gets sold, it increases the cost of sales, aka Cost of Goods Sold (COGS). It encompasses the money invested in producing goods, along with labor and material costs.

COGS = BI + P – EI

Where,

BI = Beginning Inventory

P = purchase for the period

EI = Ending inventory

COGS in the perpetual inventory system is calculated after every sale, but you can figure it for a period using this formula as well.

Gross Profit Method

Gross profit is calculated in a bit different way in a perpetual inventory system. To calculate gross profit, you might have to make an estimate of the final inventory for a particular period while preparing accounting documents and statements.

Here’s how the calculation of the gross profit method would look when you want to estimate the ending inventory from the current month.

You need to know—

- Gross profit as a percentage of total sales

- Beginning inventory for the period

- Purchases for that period

- The total sales for that period

Using this, you can figure out the estimated ending inventory and the bottom line that you have earned.

Look at the table below to get the understanding of it practically:

| Estimate | Figures |

| Sales | 100% |

| COGS | 60% |

| Gross Profit | 40% |

| Beginning Inventory | $300,000 |

| Purchases | $400,000 |

| Cost of goods available for sale | $700,000 |

| Minus COGS | $600,000 |

| Estimated Ending Inventory | $100,000 |

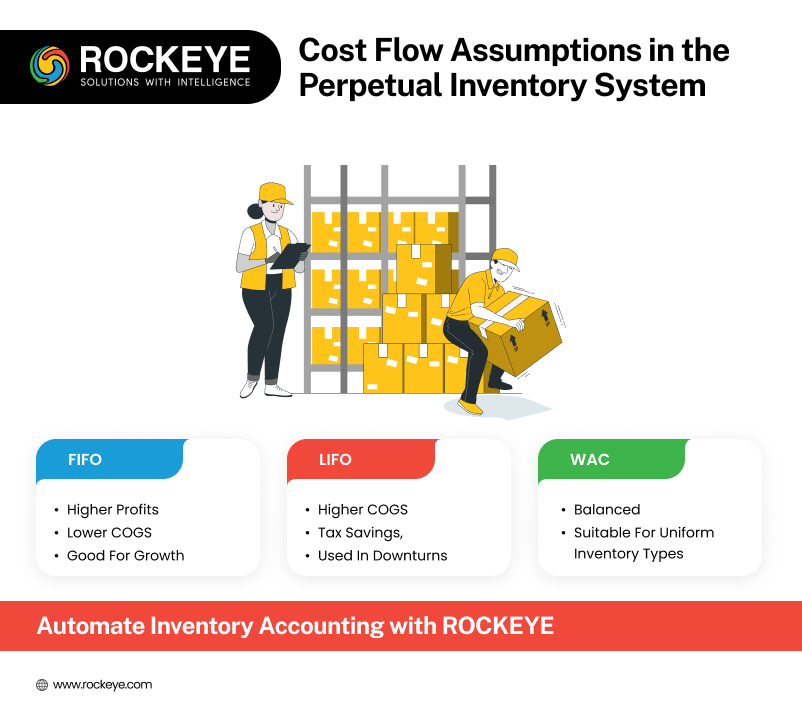

Cost Flow Assumptions to Calculate COGS and End Inventory in Perpetual Inventory System

An inventory accounting method, cost flow assumption, uses the real value of the products from the beginning inventory period and the expenses done in purchasing the new inventory in that period to calculate COGS and the ending inventory value.

There are three cost flow assumptions—FIFO, LIFO, and WAC (weighted average cost).

FIFO Perpetual Inventory Method

FIFO (first in first out) is a method to account for an inventory in a way that the stock purchased first will be sold first so that the leftover inventory is always the recently purchased inventory. For the perpetual FIFO cost flow assumption, the company records sales as they happen in the ledger. It is a cost flow estimation to evaluate the stocks.

The significant difference in the ledger in a perpetual inventory method compared to a periodic system is that the balance is a running tally of the value of sold units and the total units.

The total unit cost transferred over to the balances happens when the stock sold comes in. The value of the stock the company bought will be consistent throughout its lifecycle in the company.

The FIFO method should be used when the company is trying to show its immense potential for earning huge profits. FIFO shows fewer COGS investments and a higher bottom line.

LIFO Perpetual Inventory Method

Last in first out (LIFO) is the cost flow assumption that is used by businesses to calculate the worth of their inventory. This method also uses the running ledger tally for purchases and sales. The only difference is that here the last-placed stock is sold first, and thus the leftover inventory is the inventory that was purchased first, i.e., the oldest one.

The LIFO method is a great way to show higher COGS expenses and lower net income. This method can be used in tough times and decrease tax liabilities.

Weighted Average Cost Perpetual Inventory Method

The weighted average cost (WAC) is the average cost of goods sold for the entire inventory. The calculation for the weighted average cost is performed in a different way for the perpetual inventory system. In WAC, each inventory item is given a standard average price whenever a sale or purchase happens.

In a perpetual system, the formula that considers a specific period is not found because, in a perpetual inventory system, things change in real-time. WAC is generally used to calculate an average unit cost, ending inventory for a period, and COGS for a period.

When You Should Use Perpetual Inventory Method

Experts around the world have agreed that a perpetual inventory method is the future of inventory management, and all the large establishments that are looking to grow exponentially and understand margins and profitability should use this method.

Each time a sale or purchase happens, the perpetual inventory method records those changes in the sales revenue account. This way, the accounting records show accurate balances in the accounts affected.

Prices charged from the consumers are also reflected in the sheet. In the perpetual inventory method, you should know the purchase price (costs associated with a product like manufacturing costs and inventory carrying costs), selling price, and all the accounts affected.

FAQs

Q1. What is the perpetual inventory system and how does it work?

The perpetual inventory method of accounting for inventory, as the name suggests, is about tracking inventory ‘perpetually’ as it moves throughout the supply chain. In this approach, warehouse managers keep a continuous track of inventory balances, which means the stock is updated automatically every time an item is received or sold through every point of sale. Purchases and returns are also recorded automatically in the inventory count.

Q2. Why is the perpetual inventory system considered modern and effective?

It’s always about time; time plays a vital role in today’s world—you lose time, you lose money. The perpetual inventory system helps businesses make instantaneous changes in their inventory levels. This system became possible in the early 1970s with the use of digital computers and is now powered by barcode scanning, RFID, POSs, CRMs, and cloud-based inventory management software.

Q3. Which types of businesses should use the perpetual inventory system?

Huge businesses with multiple warehouses and large amounts of inventory generally resort to the perpetual inventory method. However, SMBs looking to grow quickly also can adopt this method to track inventory. Dropshipping companies also need it because their inventory is always moving, and they need to track the flow perpetually.

Q4. What makes perpetual inventory systems suitable for large-scale operations?

Physically counting inventory or carrying out cycle counts frequently is almost next to impossible for a large-scale industry with thousands and lakhs of SKUs. Hence perpetual inventory tracking is the most apt inventory management method.

Q5. What is the perpetual inventory formula?

Beginning inventory (usually from a physical count) + receipts – shipments = Ending inventory