Audit readiness in Kenya has become a commercial risk issue for downstream fuel operators rather than a procedural finance function. For fuel marketers, terminal owners, and distribution heads, audits now directly expose margin erosion, stock losses, pricing weaknesses, and tax reporting gaps that impact profitability and regulatory standing.

Kenya downstream fuel businesses operate in a high-volume, low-margin environment where even minor control failures can result in significant financial leakage. With tighter enforcement around digital tax compliance in Kenya and increased scrutiny from regulators and lenders, audit readiness in Kenya must be built into daily commercial operations rather than addressed retrospectively.

For C-suite leaders, the objective is clear. Protect margins, prevent revenue leakage in Kenya, and demonstrate continuous governance across terminals, depots, and retail networks.

Must read: Automated Fuel Retail Reporting: Achieving Instant Tax & Regulatory Compliance

Kenya Downstream Fuel Audit Reality

Audits in the Kenyan downstream fuel sector focus on more than financial statements. Auditors assess operational integrity across the full value chain.

Key audit focus areas now include:

- Accuracy of fuel receipts, dispatches, and sales reconciliation

- Control over pricing changes and dealer margins

- Integrity of inventory measurements and variance handling

- Alignment between operational data and tax reporting

Compliance audit services in Kenya increasingly identify control weaknesses where fuel movements, invoicing, and tax declarations are managed across disconnected systems. These gaps create audit exposure even when financial intent is sound.

For organizations handling millions of litres monthly, audit readiness software in Kenya becomes essential to maintain credibility and prevent post audit financial adjustments.

Revenue Leakage in Downstream Fuel Operations

Preventing revenue leakage in Kenya is a priority issue for downstream fuel leadership. Leakage rarely occurs as a single event. It accumulates through daily operational slippage.

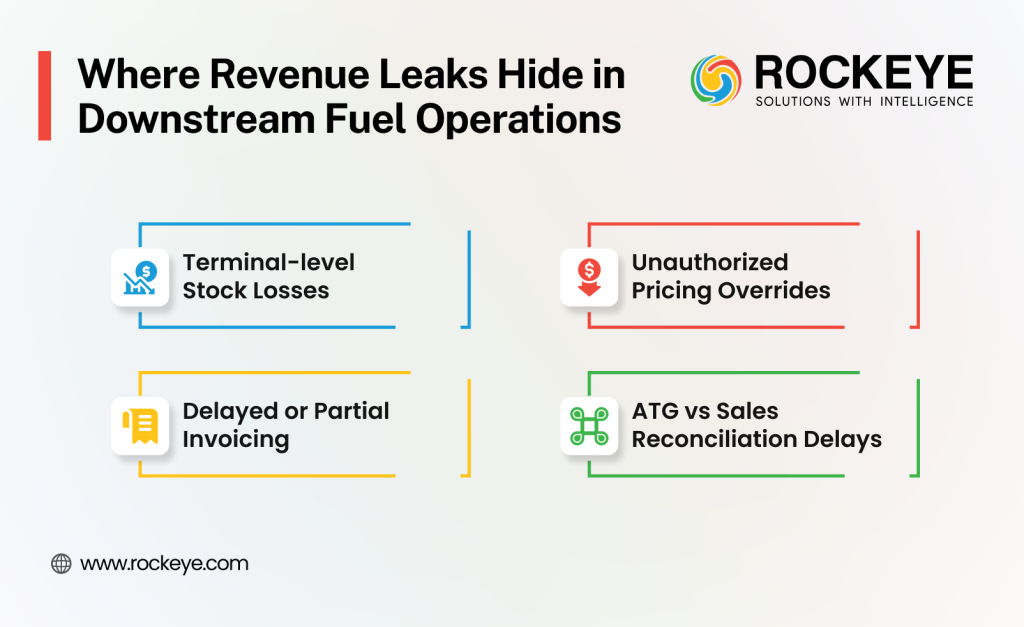

Common leakage points identified during downstream fuel audits include:

- Terminal-level stock losses are not reconciled in real time

- Unauthorized pricing overrides at depots or stations

- Delayed or partial invoicing for bulk deliveries

- Manual reconciliation delays between ATG data and sales

A loss of even 0.5 percent across terminal throughput can result in millions of shillings in annual margin erosion. Revenue assurance services in Kenya consistently highlight that most leakage remains invisible until audits surface the discrepancies.

This is why audit readiness in Kenya and margin protection must be addressed together through structured control systems.

Digital Tax Compliance and Fuel Audits in Kenya

Digital tax compliance in Kenya has significantly changed audit expectations for downstream fuel operators. Tax authorities now require consistent alignment between operational transactions and declared revenues.

Auditors assess whether fuel volumes sold, invoices raised, and taxes reported originate from verifiable system records. Manual adjustments and spreadsheet reconciliations raise immediate audit concerns.

For fuel businesses, audit readiness consultant Kenya engagements increasingly focus on system capability rather than document availability. Organizations that lack integrated commercial control face longer audits, higher compliance costs, and reputational risk.

Also Read: Zero Discrepancy Wet Stock Management

Why Generic ERP Systems Fall Short for Fuel Audits

While many downstream fuel operators use ERP platforms, these systems are typically designed for accounting consolidation rather than commercial control.

Limitations commonly observed include:

- Weak linkage between physical fuel movement and financial records

- Limited visibility into pricing governance across outlets

- Delayed reconciliation between terminals, depots, and stations

- Heavy reliance on manual intervention during audits

As a result, even companies using the best accounting software for audit compliance in Kenya still face audit pressure because operational controls are not embedded at the transaction level.

This gap is precisely where a downstream commercial control system becomes critical.

Quantified ROI of Audit Readiness Through DCCS

Implementing a structured downstream commercial control system delivers measurable financial and audit outcomes for Kenyan fuel operators.

Typical ROI outcomes observed include:

- 20 to 30 percent reduction in terminal stock losses within the first six months

- 25 percent faster month-end and audit reconciliation cycles

- 1 to 2 percent improvement in net margin through pricing and loss control

- Up to 40 percent reduction in audit preparation effort and consultancy costs

For a fuel business handling 200 million litres annually, a one percent leakage reduction can protect several hundred million shillings in revenue.

Audit readiness software Kenya, therefore, becomes a direct margin protection investment rather than a compliance expense.

Audit Readiness for Fuel SMEs and Emerging Marketers

Audit readiness for SMEs in Kenya and audit readiness for startups in Kenya in the fuel sector is often underestimated. Smaller fuel marketers face the same regulatory expectations as large players but operate with fewer controls.

Early implementation of structured commercial control delivers advantages such as:

- Faster approval from financiers and joint venture partners

- Reduced exposure during tax and statutory audits

- Stronger operational discipline from the outset

With transparent internal audit software Kenya pricing, fuel SMEs can deploy scalable controls without enterprise complexity.

Best Practices Audit Readiness for Downstream Fuel in Kenya

Best practices for audit readiness in Kenya in downstream fuel operations include the following principles:

- Real-time reconciliation between physical fuel and financial records

- Controlled pricing and margin governance across networks

- Automated audit trails for every transaction

- System-enforced approval workflows

Organizations that embed these practices experience smoother audits and stronger operational resilience.

How ROCKEYE Can Help

ROCKEYE is purpose-built to address audit readiness in Kenya for downstream fuel operators through its downstream commercial control system.

Unlike generic ERP platforms, ROCKEYE focuses on commercial governance across fuel procurement, terminal operations, distribution, pricing, and financial reconciliation.

Through its cloud-based ERP solution architecture, ROCKEYE enables:

- Real-time fuel reconciliation across terminals, depots, and stations

- Automated detection of stock and revenue variances

- Controlled pricing and margin governance aligned with contracts

- Structured audit trails supporting compliance audit services in Kenya

ROCKEYE directly supports digital tax compliance in Kenya by ensuring that operational transactions and financial declarations are fully aligned and traceable.

For organizations focused on preventing revenue leakage in Kenya, ROCKEYE delivers measurable ROI by stopping losses at source rather than explaining them during audits.

Its transparent internal audit software Kenya pricing model ensures accessibility for both large fuel networks and emerging marketers.

Conclusion

Audit readiness in Kenya for downstream fuel businesses is no longer optional. It is a core commercial control requirement that determines margin stability, regulatory confidence, and long-term sustainability.

Fuel operators that rely on manual reconciliations and fragmented systems will continue to face audit pressure and silent margin erosion. Those that adopt a downstream commercial control system gain continuous visibility, predictable audits, and stronger profitability.

For C-suite leaders, audit readiness software in Kenya is not about passing audits. It is about building a controlled, resilient fuel business where margins are protected every day, not only when auditors arrive.

FAQs

How can businesses minimize tax penalties in Kenya?

Minimizing tax penalties, Kenya requires proactive compliance rather than reactive correction. Businesses must file accurate returns on time, eliminate manual adjustments, and ensure alignment between operational data and tax reporting. Continuous monitoring through a cloud-based ERP solution helps detect discrepancies early and prevents penalties arising from under-reporting or delayed reconciliation.

How can companies protect business margins in Kenya?

Protecting business margins, Kenya depends on controlling pricing, inventory, and operational losses. Revenue leakage, unauthorized discounts, and untracked consumption erode margins silently. Implementing structured commercial control systems allows businesses to monitor margins in real time, identify variances, and prevent losses before they impact profitability.

How can Kenyan companies prevent fraud and revenue loss?

Preventing fraud and revenue loss in Kenyan companies requires system-enforced controls rather than manual oversight. Segregation of duties, automated approvals, real-time reconciliation, and exception reporting reduce opportunities for fraud. Digital audit readiness systems help identify abnormal patterns early and strengthen governance.

How do businesses protect profit margins in Kenya?

Protecting profit margins business in Kenya involves controlling both revenue generation and cost leakage. Companies must ensure accurate pricing, eliminate billing gaps, and monitor inventory variances. A downstream commercial control system strengthens margin governance by linking operations directly with financial outcomes.

What are effective strategies for preventing revenue leakage in Kenya?

Preventing revenue leakage strategies in Kenya include real-time reconciliation, automated invoicing, controlled pricing, and continuous inventory monitoring. Businesses should move away from spreadsheet-based tracking and adopt integrated systems that detect variances immediately rather than during audits.

What are common signs of revenue leakage in business operations?

Signs of revenue leakage in business operations include unexplained inventory losses, delayed invoicing, inconsistent pricing, frequent manual adjustments, and recurring audit queries. These indicators often point to weak internal controls rather than isolated errors.

What are the key financial audit preparation steps in Kenya?

Financial audit preparation steps in Kenya include verifying financial statements, reconciling inventory and sales, reviewing tax compliance, and validating approval processes. Continuous control systems simplify this process by keeping records audit-ready throughout the year.

Why are revenue leakages common in Kenyan businesses?

Revenue leakages in Kenyan businesses often arise from manual processes, disconnected systems, and a lack of real-time oversight. High-volume operations without automated controls are especially vulnerable to cumulative losses that remain unnoticed until audits.

How can utilities prevent fraud in Kenya?

Preventing fraud in Kenya utilities requires strict control over consumption data, billing accuracy, and approval workflows. Automated reconciliation and monitoring systems reduce manipulation risks and ensure transparency across operations.