Across Southeast Asia, governments are tightening the regulatory screws on greenhouse gas reporting, pollution control, and sustainability disclosures. For businesses operating in ASEAN, this is no longer a box-ticking exercise; ASEAN-wide emissions mandates are changing how companies structure operations, manage data, and prepare for external audits. This blog explains the regulatory landscape, highlights country-specific expectations (with emphasis on Singapore emissions mandates compliance, Indonesia emissions audit readiness, and Vietnam environmental compliance audit), and offers practical, sector-specific guidance, including checklists and best practices for emissions audit readiness that ASEAN companies can implement right away.

Why Emissions Mandates Matter in ASEAN

ASEAN sustainability reporting mandates and global investor pressure (ESG compliance standards in Southeast Asia) are converging to create a new normal: regulators expect robust systems for measuring, reporting, and reducing emissions.

This is driven by three forces:

- Domestic regulation aligning with international norms (e.g., greater scrutiny of Scope 1, 2, and 3 emissions reporting ASEAN-wide).

- Capital markets and trade partners are demanding credible environmental disclosures (including elements of the TCFD reporting guidelines) in Southeast Asia.

- Sectoral risk: heavy industries and complex value chains (manufacturing, oil & gas, logistics) are prime targets for audits and enforcement.

The net effect: companies must shift from sporadic sustainability efforts to sustained audit readiness, a continuous capability to demonstrate compliance and respond rapidly to inspections.

Country Snapshots: What to Expect

Singapore Emissions Mandates Compliance.

Singapore has taken a proactive approach with clear reporting frameworks and phased compliance timelines for emissions-intensive companies. Expect granular emissions reporting expectations, mandatory monitoring systems for major facilities, and linkage to incentive schemes. For businesses in Singapore, audit readiness requires demonstrable systems, traceable data architecture, and alignment with regional standards like ISO 14001 compliance and ASEAN audits, where applicable.

Indonesia Emissions Audit Readiness

Indonesia combines national environmental law enforcement with sector-specific instruments, notably for energy, forestry, and heavy industry. Indonesia’s emissions audit readiness emphasizes on-site monitoring, fuel- and process-level data, and careful documentation of mitigation measures. For multinational operators and local manufacturers, this means preparing for inspections that probe both operational controls and upstream/downstream reporting (Scope 1, 2, and increasingly 3).

Vietnam Environmental Compliance Audit

Vietnam is strengthening enforcement and increasingly requires firms to show environmental management systems and permits in order. Vietnam environmental compliance audit expectations often include wastewater and air emission controls, reporting on chemical usage, and proof of corrective actions after non-compliance events. Firms should be ready to present both process controls and evidence of continuous improvement.

Across the region, regulators are harmonizing expectations even as timelines differ, a point that makes an emissions compliance checklist for ASEAN companies particularly valuable.

Must read: Audit Readiness in Kenya: Protect Margins & Prevent Revenue Leakage

Sector Focus: Manufacturing and Oil & Gas

Manufacturing and energy remain focal points. For manufacturers, emissions sources are often diffuse (multiple process lines, boilers, solvents), making consistent measurement and documentation complex. An emissions audit checklist for manufacturing ASEAN operations should therefore focus on process mapping, meter calibration, material balance documentation, and supplier data for Scope 3 inputs.

For the energy sector, particularly downstream activities, two system-level items are essential:

- Oil & Gas Downstream Suite—Integrated software and control packages that link production, fuel accounting, and emissions calculations, giving operators a single source of truth for emissions numbers.

- Downstream Commercial Control System—Systems that manage commercial flows (sales, transfers, feedstock allocations) often double as verification layers for emissions allocations and inventory tracking.

Operators that integrate an oil & gas downstream suite with downstream commercial control system controls are better positioned to produce defensible emissions figures during audits and to adapt quickly to the regulatory timeline emissions mandates ASEAN regulators set.

Practical Audit Readiness: Checklists and Data Governance

Below are two practical checklists that companies can adopt. They’re tailored to ASEAN realities, where regulatory detail varies, but the principles remain consistent.

Emissions Compliance Checklist for ASEAN Companies (High-level)

- Identify applicable national/regional mandates and regulatory timeline emissions mandates in ASEAN for your operations.

- Map emissions sources by facility and business unit (Scope 1, 2, and relevant Scope 3 categories).

- Ensure meter and instrument calibration records are up to date and traceable.

- Implement an auditable data flow: source measurement → data capture → QA/QC → storage with versioning.

- Align reporting templates to local submission formats and to voluntary standards (ISO 14001, TCFD, where relevant).

- Maintain a register of permits, exemptions, and correspondence with authorities.

- Document governance: roles, sign-offs, and internal audit schedules.

- Run internal mock audits and preserve evidence of corrective actions.

- Train frontline staff on emissions control procedures and incident reporting.

- Maintain a remediation log for any non-compliance and proof of closure.

Emissions Audit Checklist for Manufacturing ASEAN (Detailed, Process-level)

- Process-level flow diagrams showing all emission points.

- Mass/energy balance records for key processes and raw materials.

- Calibration and maintenance logs for emission monitoring systems (CEMS, stack tests).

- Fuel purchase and consumption ledgers reconciled with production.

- Records of leak detection & repair (LDAR) programs and VOC controls.

- Waste handling and fugitive emission controls documentation.

- Supplier declarations and upstream emissions data for Scope 3 estimates.

- Internal verification reports and third-party verification certificates (if available).

- Evidence of ISO 14001 compliance and ASEAN audit steps, if the company claims certification.

- Board-level ESG disclosures and linkage to TCFD reporting guidelines, Southeast Asia, if applicable.

Systems and Standards: Where to Invest

Regulatory expectations increasingly favor systems over spreadsheets. Investment in an oil & gas downstream suite or a robust enterprise emissions management platform pays off because it:

- Automates data capture from process control systems and financial/commercial systems.

- Bridges operational data and commercial allocations via a downstream commercial control system, improving traceability of emissions per product or customer.

- Supports audit trails, version control, and role-based approvals, all critical for demonstrating audit readiness for emissions reporting that ASEAN regulators expect.

Compliance is also easier when aligned to standards: pursuing ISO 14001 compliance and ASEAN audit requirements helps institutionalize environmental management practices; adopting TCFD-aligned disclosures prepares companies for investor scrutiny in Southeast Asia.

Also read: Automated Fuel Reporting: How Commercial Control Systems Drive Compliance

Reporting Realities: Scope 1, 2, 3, and Beyond

Regulators and buyers are increasingly asking for Scope 1, 2, and 3 emissions reporting in ASEAN. While Scope 1 and 2 are becoming standard regulatory requirements, Scope 3 remains complex but unavoidable because it reflects the broader value chain impact.

Best practice is to:

- Prioritize accurate Scope 1 and 2 reporting with documented methodologies.

- Triage Scope 3 categories: identify the most material (e.g., purchased goods, downstream use of sold products, logistics) and focus data collection there.

- Use recognized standards and methodologies so that external auditors can follow your calculations.

Governance, Audits, and Penalties

Regulators are also developing enforcement pathways. The penalties for non-compliance with emissions in ASEAN can include fines, operational restrictions, reputational damage, and, in severe cases, shutdown orders. Audit readiness reduces both the likelihood and the severity of penalties by demonstrating control and remediation capability.

Internal governance should mirror external expectations: maintain an audit calendar, escalate findings to senior management, and integrate emissions performance into executive KPIs. For investment-grade credibility, engage reputable third-party verifiers and document the scope of verification.

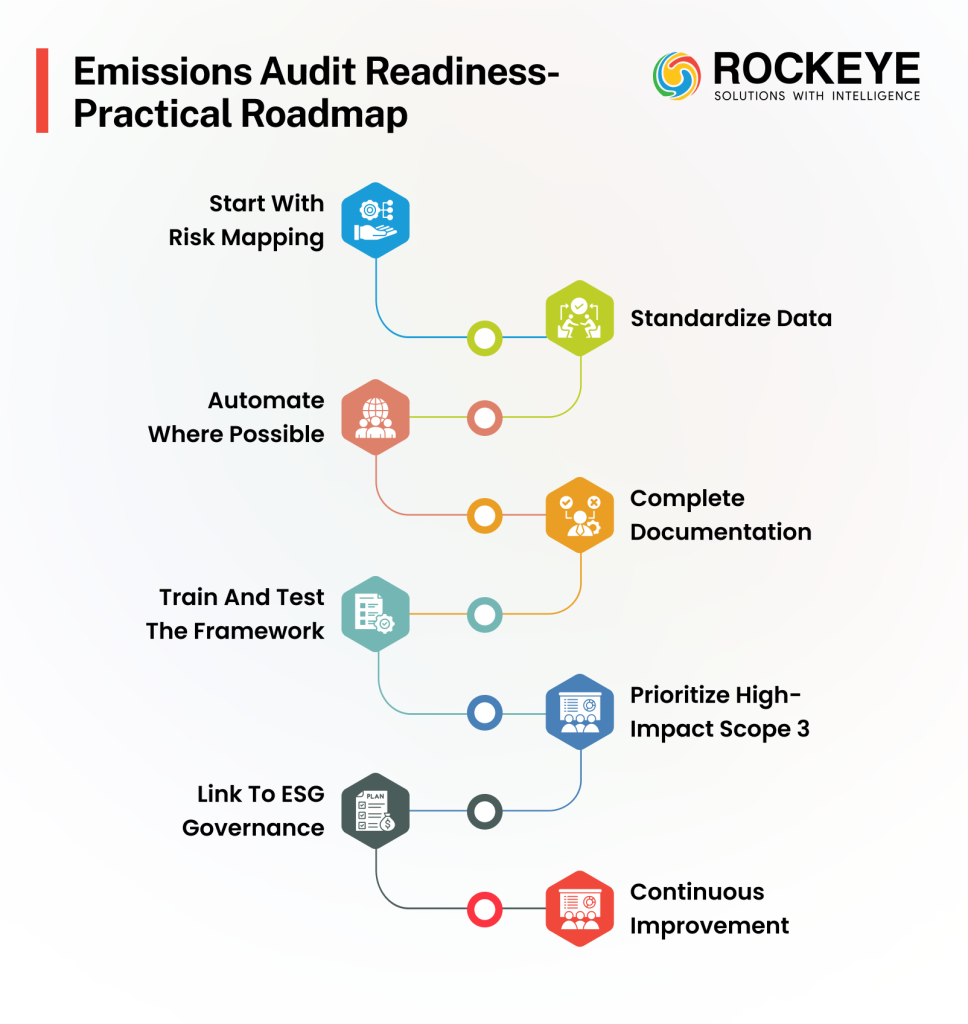

Best Practices for Emissions Audit Readiness in ASEAN

- Start with risk mapping—know where you are most exposed (facilities, supply chains, products).

- Standardize data—a single source of truth for emissions numbers reduces errors and speeds audit responses.

- Automate where possible—integrate CEMS, ERP, and oil & gas downstream suite modules with your downstream commercial control system.

- Document everything—audits hinge on evidence; keep clear trails for every number reported.

- Train and test—run mock audits, tabletop exercises, and scenario planning for regulatory inspections.

- Prioritize high-impact Scope 3—get supplier cooperation and use conservative estimation where data gaps exist.

- Link to ESG governance—align disclosures with ESG compliance standards, Southeast Asia, and regional guidance, such as TCFD reporting guidelines, for Southeast Asia investors.

- Continuous improvement—treat audit outcomes as inputs for operational and system upgrades.

These best practices, emissions audit readiness, and ASEAN examples show that preparedness is as much organizational as it is technical.

Looking Forward: Regulatory Timeline and Strategic Implications

The regulatory timeline for emissions mandates in ASEAN varies by country: some have phased targets and reporting windows; others are rapidly iterating on rules. The pragmatic response for companies is to build adaptable systems that can support increasingly sophisticated disclosures and to keep legal and compliance teams closely engaged with operations.

For firms in high-risk sectors, the cost of inaction is rising, not just from fines, but from restricted market access and investor divestment. Conversely, companies that can demonstrate audit readiness and robust emissions management gain a competitive advantage: easier access to capital, supply chain preferences, and smoother regulatory interactions.

How Can ROCKEYE Help

ROCKEYE supports organizations across ASEAN in strengthening emissions compliance and audit readiness through integrated downstream and emissions management capabilities.

By combining operational data, commercial controls, and regulatory reporting workflows, ROCKEYE enables companies to build a single source of truth for emissions data. Its solutions help organizations align operational measurements with commercial transactions, making emissions calculations more accurate, traceable, and auditable.

For downstream energy and manufacturing-intensive environments, ROCKEYE’s platform supports regulatory reporting, internal audits, and continuous monitoring while reducing manual effort and compliance risk. This approach allows enterprises to respond confidently to changing emissions mandates and evolving audit expectations across Southeast Asia.

Conclusion

ASEAN-wide emissions mandates are catalyzing a shift from ad hoc sustainability measures to disciplined, evidence-driven compliance and audit readiness. Whether you are a manufacturer preparing an emissions audit checklist for manufacturing in ASEAN, an oil & gas operator integrating an oil & gas downstream suite with a downstream commercial control system, or a regional head navigating Singapore emissions mandates compliance or Indonesia emissions audit readiness, the path forward is the same: map your emissions, standardize data, automate controls, and institutionalize audit-ready practices.

Adopt the checklists above, prioritize systems that create traceable data flows, and align governance to ISO and TCFD frameworks where relevant. That way, you’ll be ready for today’s audits and tomorrow’s mandates, converting regulatory pressure into operational resilience and sustainable growth.

Frequently Asked Questions

What is audit readiness for environmental regulations that ASEAN companies must achieve?

Audit readiness for environmental regulations ASEAN companies face means having accurate emissions data, documented controls, auditable systems, and trained teams that can demonstrate compliance during regulatory inspections without last-minute preparation.

How to prepare for the emissions audit ASEAN regulators conduct?

To prepare for ASEAN regulators’ emissions audits, organizations should map emissions sources, verify measurement accuracy, maintain permits and documentation, conduct internal audits, and ensure emissions data is traceable from source to report.

What are the challenges of emissions mandates that ASEAN manufacturing companies face?

Challenges ASEAN manufacturing firms encounter with emissions mandates include fragmented data sources, complex process emissions, limited Scope 3 visibility, evolving regulations, and the need for system-driven reporting rather than spreadsheets.

How should companies prepare for mandatory climate disclosures across ASEAN?

Preparing for mandatory climate disclosures ASEAN regulators are introducing requires alignment with ESG frameworks, robust emissions measurement, governance integration, and readiness for third-party verification.

How can organizations measure emissions reduction targets that ASEAN regulators expect?

Measuring the targets for emissions reductions that ASEAN authorities expect involves establishing baselines, tracking operational efficiency improvements, monitoring fuel and energy use, and documenting verified reductions over time.

How do emissions mandates affect compliance in ASEAN organizations?

How emissions mandates affect compliance in ASEAN is by increasing reporting frequency, audit scrutiny, system requirements, and penalties, pushing organizations toward continuous compliance rather than periodic reporting.

What are Malaysia’s mandatory emissions standards, and how do they impact businesses?

Malaysia’s mandatory emissions standards require regulated facilities to monitor and report emissions while complying with sector-specific limits, increasing the need for structured data management and audit readiness.

What is the impact of emissions mandates on supply chains ASEAN-wide?

The impact of ASEAN-wide emissions mandates on supply chains includes increased Scope 3 reporting requirements, supplier data validation, and the need for collaboration across logistics, procurement, and operations.

What penalties for non-compliance with emissions should ASEAN companies expect?

Penalties for non-compliance with ASEAN emissions regulations may include financial fines, operational restrictions, delayed permits, reputational harm, and increased regulatory scrutiny.

Why is audit readiness for emissions reporting in ASEAN organizations critical?

Audit readiness for emissions reporting that ASEAN organizations require is critical because it reduces compliance risk, avoids penalties, supports investor confidence, and enables faster adaptation to evolving environmental regulations.