In the high-stakes world of the energy and retail sectors, the final mile of the supply chain is often where profitability and legality collide. For C-suite leaders in Kenya, Malaysia, and Indonesia, the regulatory landscape has never been more demanding. As we navigate 2026, authorities such as Kenya’s Energy and Petroleum Regulatory Authority (EPRA) and Malaysia’s Ministry of Domestic Trade are no longer just conducting periodic checks; they are utilizing real-time data to identify discrepancies.

A single downstream supply chain oversight can lead to more than just a slap on the wrist. We are seeing fines reaching into the millions of dollars, license revocations, and irreversible reputational damage. To protect your enterprise, you must look beyond the surface of your operations.

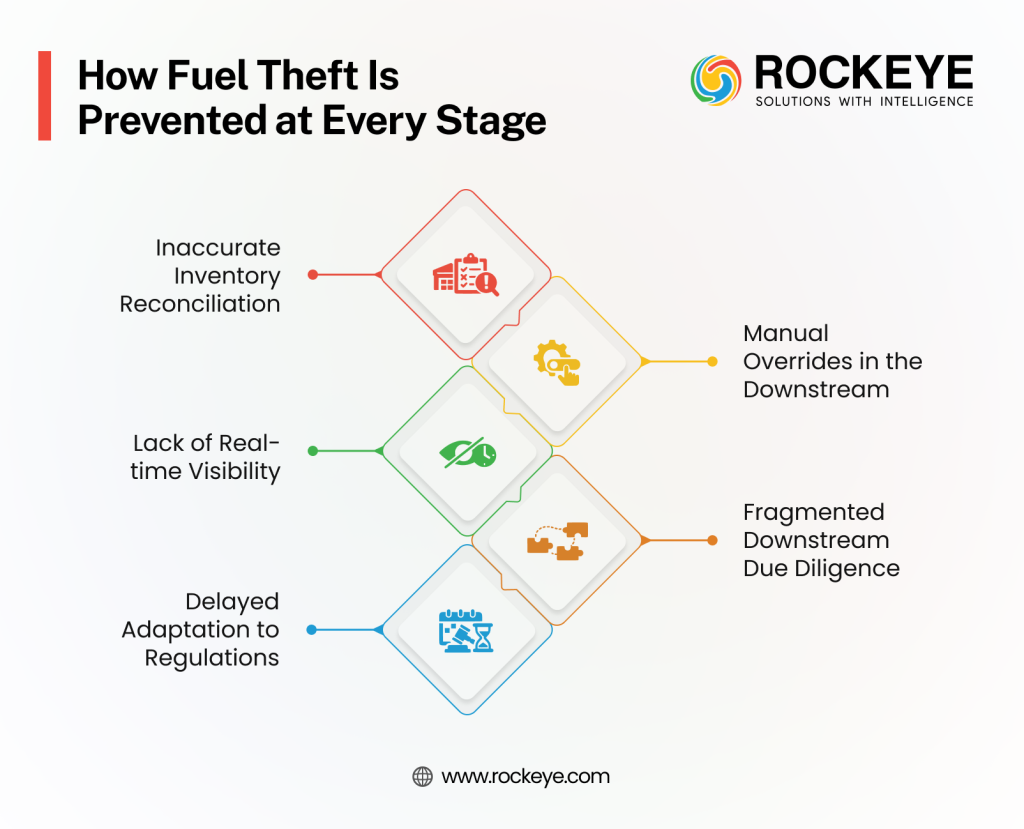

1. Inaccurate Inventory Reconciliation and Leakage Gaps

One of the most persistent compliance failures occurs at the intersection of physical stock and digital records. In many downstream activities, there is a significant lag between the moment fuel or goods leave a terminal and when they are recorded in the central system.

If your warehouse inventory management software is not integrated directly with your gantry meters or tank gauges, you are likely operating with “ghost numbers.” Regulators in Indonesia and Kenya are increasingly penalizing firms for variance discrepancies that exceed 0.5%. These gaps are often flagged as potential tax evasion or unauthorized sales, even if they are simply the result of poor tracking.

2. Manual Overrides in the Downstream Commercial Control System

Relying on manual data entry for pricing and volume is a recipe for disaster. A robust downstream commercial control system should prevent unauthorized price overrides or volume adjustments. However, many organizations still allow local managers to manually edit “delivery notes” or “loading tickets.”

When a regulator audits your downstream value chain, they look for “audit trails.” If they find that terminal operators can manually change the density or temperature of a fuel load without a multi-layer approval, it triggers an immediate red flag. We can help your business grow with our exemplary services by automating these gatekeepers, ensuring that every drop is accounted for at the correct price and tax bracket.

3. Lack of Real-time Visibility in Transport Management

The “blind spot” between the depot and the retail station is where most downstream operations lose both money and compliance standing. Without a sophisticated transport management system, companies struggle to prove that their products reached the intended destination without tampering or unauthorized diversion.

In Malaysia and Indonesia, strict “Movement of Goods” regulations require precise geofencing and time-stamping. If your fleet deviates from a prescribed route and you cannot explain why, you are liable for fines related to illegal trade and subsidy leakage.

4. Fragmented Downstream Due Diligence on Third-Party Partners

Your compliance is only as strong as your weakest distributor. Many C-suite leaders overlook downstream due diligence when it comes to third-party transporters and franchise dealers.

Are your partners adhering to environmental safety standards? Are they using calibrated meters? If a partner fails an inspection, the “Polluter Pays” and “Chain of Responsibility” laws in many jurisdictions mean the fine travels all the way up to you. Conducting a regular compliance gap assessment on your partners is no longer optional; it is a survival tactic.

5. Delayed Adaptation to Evolving Regional Regulations

Regulations are not static. In 2026, we are seeing a shift toward “Digital-First” compliance. For instance, Kenya’s transition to fully electronic tax invoicing and Malaysia’s updated ESG reporting for logistics have caught many legacy businesses off guard.

A common compliance gap is the delay between a regulatory change and the update of internal software logic. If your system is still calculating levies based on 2024 rates, you are essentially self-reporting a violation with every invoice generated. You can avoid this by working with us to implement a system that updates in sync with regional mandates.

Must read: Audit Exposure from Dispatch Overrides: The Hidden Risk in Downstream Fuel Operations

How ROCKEYE Transforms Your Downstream Operations

At ROCKEYE, we understand that for a C-suite executive, compliance is not just about avoiding fines; it is about creating a predictable, scalable business. Our downstream operations suite is specifically engineered to close the gaps mentioned above.

- Unified Control: We replace fragmented spreadsheets with a single source of truth that connects your terminal, your fleet, and your retail network.

- Automated Governance: Our system enforces “zero-override” policies. Pricing, tax slabs, and inventory movements are locked behind multi-layer approvals.

- Real-time Audit Readiness: Instead of spending weeks preparing for an audit, ROCKEYE allows you to generate a full, validated history of your downstream value chain in minutes.

We don’t just provide software; we provide the commercial discipline required to dominate the market. We can help your business grow with our exemplary services by turning compliance from a cost center into a competitive advantage.

FAQs: Mastering Downstream Compliance

How can organizations identify downstream compliance gaps early?

Organizations can identify gaps by performing a regular compliance gap analysis that compares physical operational data against regulatory requirements. Using an integrated downstream commercial control system helps by flagging anomalies in real-time, such as inventory variances or unauthorized price changes, before they become audit issues. ROCKEYE provides built-in analytics that highlight these risks automatically.

What downstream compliance risks are most often overlooked by companies?

The most overlooked risks include third-party transporter behavior, “hidden” inventory shrinkage, and the lack of a digital audit trail for manual adjustments. Companies often focus on the “big” regulations but fail to monitor the daily downstream operations where small errors compound into massive fines.

What controls help prevent downstream compliance failures?

Key controls include automated inventory reconciliation, geofencing within a transport management system, and multi-layer digital approvals for all commercial transactions. Implementing a “system-enforced” workflow ensures that employees cannot bypass compliance protocols, a feature central to the ROCKEYE O&G Suite.

How can businesses reduce downstream compliance risks and penalties?

Businesses can reduce risk by transitioning from manual paper-based processes to an integrated ERP solution. By centralizing data from all downstream activities, companies ensure transparency. Utilizing a solution like ROCKEYE helps by providing pre-configured compliance modules tailored for regions like Kenya, Malaysia, and Indonesia.

How do regulators detect downstream compliance gaps?

Modern regulators use data triangulation, comparing your tax filings against terminal loading data and retail sales records. If these three points do not align, they trigger a compliance gap assessment. Automated systems ensure your data is consistent across all touchpoints, leaving no room for discrepancies.

What are the best practices for managing downstream compliance risks?

Best practices include conducting an annual compliance gap analysis, automating the “Chain of Custody” for all products, and investing in specialized warehouse inventory management software. It is also vital to ensure your software provider has a local footprint in Malaysia, Indonesia, or Kenya to stay ahead of regional law changes.

What solutions help companies close downstream compliance gaps?

The most effective solutions are purpose-built downstream ERPs like ROCKEYE. Unlike generic accounting software, ROCKEYE integrates with physical hardware (meters, tanks, GPS) to ensure that your digital records are a 100% accurate reflection of your physical downstream supply chain.