Introduction: The Silent Profit Drain

Dealer‑network leakage, also known as channel leakage, is the invisible tax many Vietnamese manufacturers pay without even realizing it. It’s the loss of stock, margins, or revenue between the factory gate and the final dealers or customers, caused by untracked discounts, unauthorized diversion, sub‑dealer arbitrage, transit pilferage, or compliance lapses.

In Vietnam’s dynamic market landscape spanning agro-processing, FMCG, pharmaceuticals, and fast-moving commodities such leakage is especially dangerous. Fragmented dealer networks, long transport routes, export compliance pressures, and inconsistent digital maturity amplify the risk.

And in 2026, with margins tightening and competition intensifying, these losses are no longer acceptable. Companies that ignore dealer‑network leakage aren’t just losing profit; they’re undermining long-term brand integrity and operational stability.

That’s why adopting a commercial control layer isn’t just a best practice anymore; it’s a strategic imperative for Vietnamese manufacturers aiming to scale, export, and protect profitability.

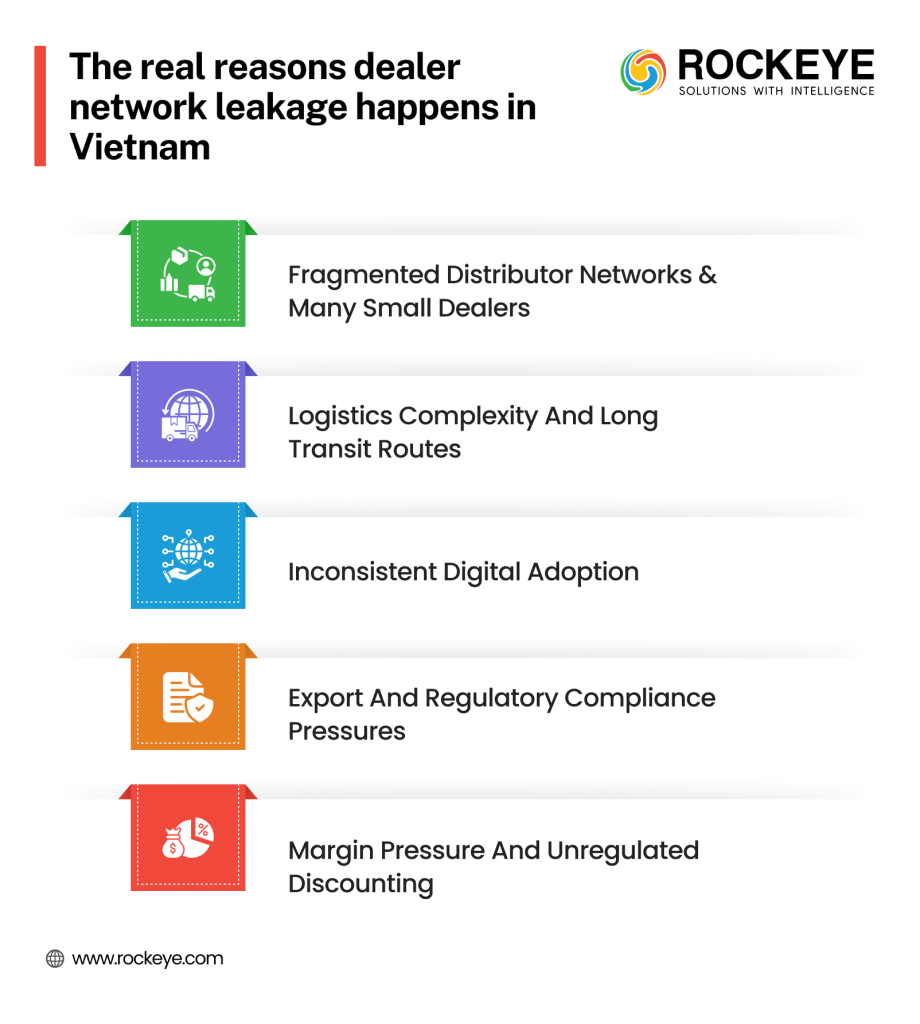

Why Dealer-Network Leakage Happens in Vietnam

Vietnam’s distribution ecosystem has several structural vulnerabilities that make dealer-network leakage more common than many realize:

Fragmented Distributor Networks & Many Small Dealers

Especially outside major urban centres, dealers and sub‑dealers operate in loosely controlled networks. Monitoring each node is challenging, creating gaps for unauthorized discounts, gray‑market diversion, or parallel selling.

Logistics Complexity and Long Transit Routes

Goods shipped from manufacturing hubs to remote provinces go through multiple transit points, warehouses, or transit hubs, increasing the risk of pilferage, stock loss, or diversion.

Inconsistent Digital Adoption

While some leading firms use modern ERPs or supply chain suites, many dealers still rely on spreadsheets or manual records, making real‑time traceability and compliance enforcement nearly impossible.

Export and Regulatory Compliance Pressures

For export‑oriented products (agro‑goods, seafood, processed foods, etc.), a single non‑compliant batch can lead to rejected shipments, yet downstream dealers or sub‑dealers often escape visibility, making compliance enforcement weak.

Margin Pressure and Uncontrolled Discounting

Territorial overlap, competitive discount wars, or incentive-seeking behaviour from dealers can lead to unauthorized discounts or volume manipulation, causing margin leakage.

These structural and behavioural causes combine to create a “perfect storm” where leakage becomes systemic, not incidental.

The Financial Impact of Channel Leakage

Dealer‑network leakage doesn’t just show up as missing stock or inconsistent deliveries; it hits the bottom line hard. Here’s how:

Margin Erosion

Unauthorized discounts, hidden rebates, or unapproved price deviations eat into expected gross margins.

Inventory Shrinkage

Stock lost in transit or diverted to unauthorized channels increases the cost of goods sold (COGS) and reduces inventory turnover.

Forecasting & Planning Errors

Misreporting or underreporting of actual sales distorts demand forecasts, leading to overproduction or stockouts.

Brand Risk & Compliance Costs

Quality or compliance failures at the dealer level, especially for export products, can trigger recalls, rejected orders, or reputational damage.

Operational Inefficiency

Without visibility, management spends excessive time reconciling data, auditing dealers, or manually chasing deviations, draining resources.

Hypothetical Example: Suppose a mid-sized FMCG exporter with an annual revenue of USD 20 million experiences just 5% channel leakage that’s USD 1 million lost in revenue or margin each year.

A distribution network with 100+ dealers, multiple sub-dealer layers, and fragmented logistics could easily see 5–10% “invisible losses” if unchecked. That’s why leakage isn’t just a compliance problem, it’s a strategic drain.

Also Read: Downstream Supply Chain Control – Real-Time Visibility in Fuel Transport

Why Traditional ERP and Distributor Oversight Often Fall Short

Many Vietnamese manufacturers have invested in cloud ERP systems to manage production, inventory, invoicing, and logistics. But most ERPs and traditional distributor oversight mechanisms are operationally focused, not governance focused.

What they typically lack:

- Real‑time monitoring of dealer pricing or discount compliance

- Channel‑level visibility across multi-tier distribution (manufacturer → distributor → sub‑distributor → dealer → custome

- Predictive analytics or alerts for unusual stock movement or margin diversion

- Batch‑level traceability or export‑compliance enforcement across the entire dealer network

In essence, ERP systems can track “what was produced” and “what was shipped to Distribution Point A”. But they rarely track “what finally reached Dealer X in Province Y, at what margin, under what terms.” That blind spot is often where leakage thrives.

What a Commercial Control Layer Does

This is where a commercial control layer (CCL) becomes indispensable, especially in complex markets like Vietnam, with large, fragmented dealer networks and export‑driven compliance needs.

A robust CCL:

- Provides dealer performance analytics tracking sales, returns, discounting, regional performance, and compliance metrics.

- Enforces distributor compliance standard pricing policies, margin rules, rebate/discount authorization, and contract enforcement.

- Enables channel leakage detection monitoring product flow across all tiers to detect diversion, parallel selling, or gray‑market distribution.

- Provides margin leakage analytics comparing invoiced price against approved price/BOM to detect unauthorized discounts or margin drops.

- Offers batch-level traceability & quality compliance crucial for export-oriented goods, ensuring any product leaving the factory can be traced through every dealer and end-distributor.

- Delivers real-time dashboards and alerts for decision-makers, enabling proactive intervention rather than reactive audits.

In short, a CCL acts as a governance and intelligence layer above ERP, giving leadership real-time visibility, control, and accountability across the entire dealer/distributor network.

ROCKEYE: The Solution for Vietnam’s Dealer-Network Challenges

If you’re looking for a ready-to-deploy solution tailored for complex supply chains and dealer networks, ROCKEYE fits the bill.

ROCKEYE isn’t just another ERP extension; it’s a full-fledged Industrial Digital Control System (IDCS) that embeds a Commercial Control Layer for manufacturing and distribution companies.

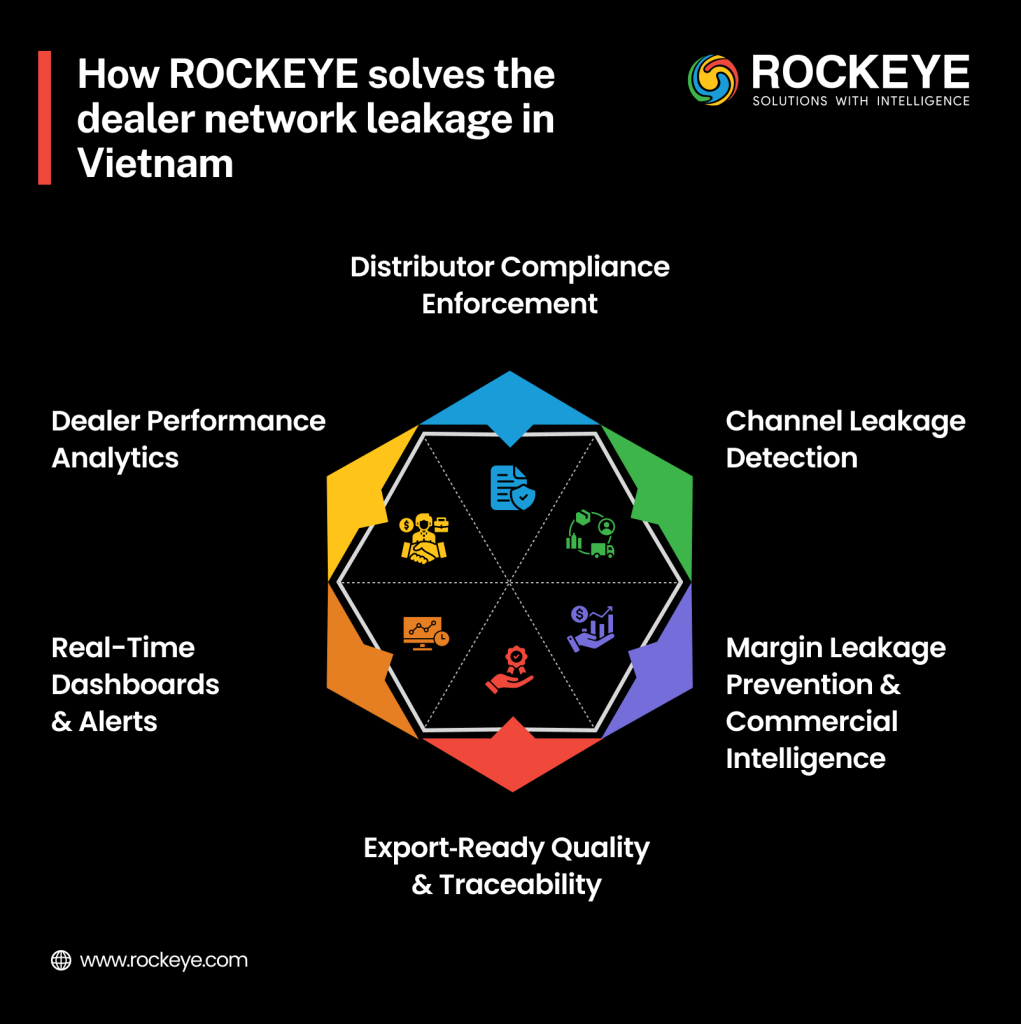

What ROCKEYE Brings to the Table

Dealer Performance Analytics

ROCKEYE tracks every dealer’s transaction history, discount patterns, returns, regional sales performance, and compliance metrics.

Distributor Compliance Enforcement

The system automatically flags any deal that violates approved pricing, rebate, or margin rules, preventing unauthorized discounts or margin leakage in real time.

Channel Leakage Detection

Through end-to-end supply chain visibility, ROCKEYE traces product flow from factory to final dealer, exposing gray‑market diversions or parallel distribution

Margin Leakage Prevention & Commercial Intelligence

By comparing invoice data, discount usage, and actual selling prices, ROCKEYE identifies margin drift and alerts finance or sales leaders before losses compound.

Export‑Ready Quality & Traceability

For exporters (agro, food, pharmaceuticals), ROCKEYE ensures batch‑level traceability and compliance across all distribution tiers, protecting brand integrity and export eligibility.

Real-Time Dashboards & Alerts

For CEO, CFO, and operational leaders, immediate visibility into dealer compliance, margin health, channel performance, and risk zones.

How ROCKEYE Works in Practice

In a typical deployment, a mid‑sized consumer goods manufacturer with 150+ dealers across Vietnam might see results like:

- Margin leakage reduced from ~6% to ~1–2%

- Unauthorized discounts and rebates cut to <1%

- Full visibility into dealer network performance, compliance, and stock flow

- Real-time commercial intelligence enabling proactive governance and strategic decision‑making

With ROCKEYE, companies transition from reactive audits and spreadsheet chaos to proactive control, margin protection, and scalable growth.

Measurable Benefits & Expected ROI

Deploying a commercial control layer like ROCKEYE yields concrete, measurable benefits often within a 90‑day pilot. Companies typically see:

Leakage reduction: Significant drop in unauthorized discounts, stock pilferage, and margin drain

Margin protection: Restored margins, reduced discount leakage, improved profitability

Improved distributor compliance: More consistent pricing, adherence to contracts, and reduction of grey‑market diversion

Operational visibility & control: Real-time dashboards, analytics, alerts, and traceability

Scalability: Ability to scale the network without a proportional increase in governance overhead

KPI Improvements

| Metric | Before CCL (ERP-only) | After CCL (90 days) |

|---|---|---|

| Margin leakage % | ~6% | ~1–2% |

| Unauthorized discounting % | ~5% | <1% |

| Stock pilferage / shrinkage | ~4% | <0.5% |

| Dealer compliance rate | ~70% | >95% |

| Network Flow Visibility | ~50% | ~100% |

These improvements translate into margin protection, reduced write‑offs, better forecasting, and stronger export compliance, all critical for high-growth Vietnamese manufacturers.

Conclusion: From Leakage to Leadership

Dealer‑network leakage is not a minor operational anomaly, it’s a strategic threat to profitability, growth, and brand integrity for Vietnamese manufacturers. But with a well-implemented commercial control layer, combined with dealer performance analytics, commercial intelligence, and real-time governance, what was once invisible becomes manageable.

ROCKEYE offers exactly this: a ready-to-deploy solution that transforms your dealer network from a leak‑prone liability into a competitive asset.

Book a Demo today to See How ROCKEYE Controls Leakage in Real Time and turn dealer‑network leakage into margin protection, operational visibility, and sustainable growth.

FAQs — Answering What Decision-Makers Are Searching

What is dealer‑network leakage in distribution systems?

Dealer‑network leakage (or channel leakage) refers to losses in margin, revenue, or product between the manufacturer and end dealers. It often occurs due to unauthorized discounts, parallel distribution, stock diversion, or lack of compliance oversight.

How does a commercial control layer stop margin leakage?

A commercial control layer adds governance, transparency, and real-time monitoring over dealer and distributor networks. It enforces pricing policies, tracks transactions, flags deviations, ensures compliance, and prevents unauthorized discounts or diversion, thereby protecting margin.

Why is Vietnam more vulnerable to channel leakage than developed markets?

Vietnam’s distribution networks are often fragmented, with many small dealers spread across provinces, inconsistent digital adoption, long transit routes, export-driven compliance pressures, and logistical challenges all increasing the risk of leakage.

Can existing ERP systems handle dealer-network leakage prevention?

No. Traditional ERP systems focus on production planning, inventory, and invoicing. They lack the governance, compliance enforcement, dealer-level analytics, and real-time visibility required to detect and prevent channel leakage.

What are the typical ROI improvements after deploying a commercial control layer?

Companies often see margin leakage reduce from ~5–6% to ~1–2%, unauthorized discounts drop below 1%, dealer compliance rise above 95%, and overall visibility across the network reach nearly 100% usually within 60–90 days.

How does dealer performance analytics help improve distribution efficiency?

Dealer performance analytics provides real-time sales data, return/discount analytics, compliance scoring, and trend analysis. It enables leaders to identify underperforming dealers, compliance risks, diversion patterns, and take corrective action proactively.

Why should manufacturing leaders act now to implement a commercial control layer?

With rising global competition, tighter export compliance, shrinking margins, and increasing network complexity, 2026 is a pivot year. Companies that implement control layers now will protect margins, ensure compliance, and scale safely while competitors relying on manual or ERP-only systems lag.