In high-risk fuel networks, compliance is no longer optional; it is critical. Yet, many fuel companies continue to treat compliance reporting as a secondary task, often only addressed during audits or regulatory inspections. This reactive approach exposes fuel networks to financial losses, operational disruptions, and reputational damage, particularly in regions like Kenya, Malaysia, and Indonesia, where fuel supply chains are complex and heavily regulated.

According to the International Energy Agency, global fuel supply chain errors result in annual losses of up to 3–5% of total fuel volumes in emerging markets. In high-risk networks, this figure can escalate due to weak reporting, manual workflows, and inconsistent regulatory adherence.

The question for fuel operators is simple: Can your network afford to treat compliance as an afterthought?

Why Fuel Network Compliance Reporting Is More Critical Than Ever

Fuel network compliance reporting serves as the backbone of operational control. It ensures adherence to regulatory standards, prevents unauthorized fuel movement, and safeguards profit margins. Without a fluid terminal management system and effective reporting, fuel companies face:

- Regulatory Penalties: Governments in Kenya, Malaysia, and Indonesia impose strict fines for underreporting or inaccurate documentation of fuel movement.

- Financial Leakage: Untracked transactions, inaccurate inventories, and manual overrides can result in millions in annual losses.

- Reputational Damage: Non-compliance can harm relationships with stakeholders, including investors, suppliers, and customers.

A PwC study found that 38% of fuel companies globally reported significant compliance breaches, mostly due to manual reporting processes and outdated systems.

High-risk fuel network compliance is not just about meeting legal obligations; it is a critical lever for risk management, margin protection, and operational efficiency.

Understanding the Biggest Compliance Risks in Fuel Distribution

Fuel distribution involves complex operations spanning terminals, depots, retail stations, and transportation networks. Each stage introduces potential risks:

- Inventory Shrinkage: Manual stock monitoring increases the likelihood of theft or misreporting.

- Dispatch Overrides: To meet urgent delivery requirements, operators may bypass standard checks, creating reporting gaps.

- Regulatory Misalignment: Frequent changes in fuel taxation, local fuel standards, and licensing regulations make staying compliant challenging.

- Data Inaccuracy: Manual logbooks and disconnected systems result in inconsistent compliance reporting.

- Supply Chain Disruptions: Delayed approvals or inaccurate documentation can halt distribution, affecting throughput and revenue.

Fuel supply chain compliance risks are therefore multifaceted, involving operational, financial, and regulatory dimensions.

Regulatory Compliance in Fuel Distribution: Regional Perspectives

Kenya

The Energy and Petroleum Regulatory Authority (EPRA) mandates strict reporting on fuel imports, movement, and storage. Non-compliance can result in fines exceeding KES 5 million and license suspension.

Malaysia

The Ministry of Domestic Trade and Consumer Affairs requires fuel companies to maintain precise documentation of sales and distribution. Audit failures have cost some operators up to MYR 1.2 million annually.

Indonesia

Fuel supply chains are regulated by Pertamina and regional energy regulators. Operators must maintain automated reporting and comply with monthly audit requirements, with penalties reaching IDR 500 million for reporting failures.

Understanding these regional fuel network regulatory requirements is critical to avoiding financial and operational risks.

The Operational Impact of Compliance Failures in Fuel Operations

Ignoring compliance or treating it as a reporting afterthought has tangible consequences:

- Financial Losses: Undocumented fuel movement and incorrect tax reporting directly affect the bottom line. For instance, Malaysian terminals have reported losses of up to 2% of revenue due to inventory mismanagement.

- Operational Disruption: Delayed regulatory approvals or audit failures can halt distribution, causing stock shortages and delivery delays.

- Legal Exposure: Non-compliance exposes companies to lawsuits, heavy fines, and license revocation.

- Margin Erosion: Without accurate compliance reporting, companies cannot fully control pricing, FX adjustments, or margin governance.

Companies that integrate automated compliance processes report 20–30% faster audit turnaround and significantly reduced operational leakage.

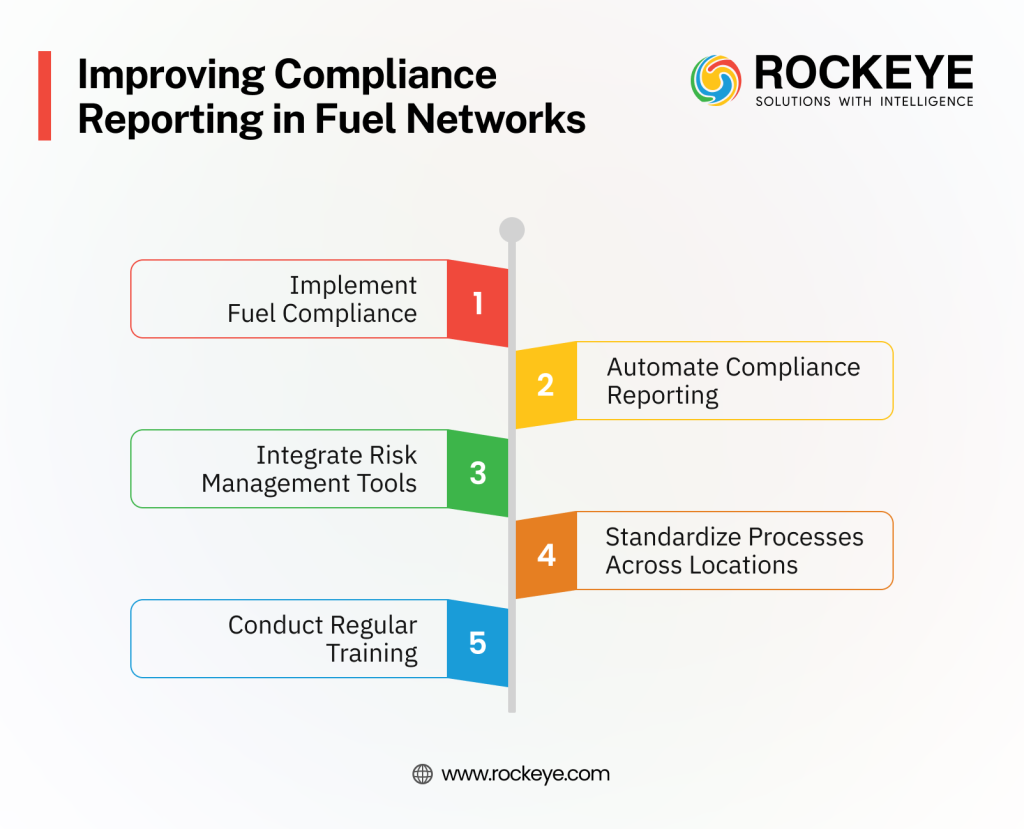

How to Improve Compliance Reporting in Fuel Networks

Improving compliance reporting requires a combination of policy, process, and technology:

1. Automate Compliance Reporting

Manual reporting is slow and error-prone. Automated compliance reporting for fuel networks ensures real-time tracking of fuel movement, accurate documentation, and instant regulatory reporting.

2. Implement Fuel Compliance Management Software

Modern smart fuel station management software connects terminals, depots, and retail networks, providing a single source of truth for inventory, sales, and regulatory reporting.

3. Integrate Risk Management Tools

Fuel network risk management tools identify anomalies in stock movement, pricing, or distribution, allowing proactive interventions before compliance failures escalate.

4. Standardize Processes Across Locations

High-risk fuel network compliance improves when standard operating procedures are consistently applied across all depots, stations, and logistics partners.

5. Conduct Regular Training

Employees at terminals and depots must understand fuel network regulatory requirements and the importance of compliance reporting in operational and financial performance.

Must Read: Instant Tax & Regulatory Compliance: How Commercial Control Systems Automate Fuel Retail Reporting

ROCKEYE: Your Partner in Fuel Network Compliance

ROCKEYE provides end-to-end compliance reporting solutions for fuel companies, designed specifically for high-risk networks in Kenya, Malaysia, and Indonesia. Unlike generic ERP systems, ROCKEYE ensures economic governance, risk reduction, and margin protection.

Key Benefits of ROCKEYE for Fuel Networks

- Automated Fuel Reporting: Real-time dashboards and automated alerts reduce manual errors.

- Fuel Network Risk Management: Identify leakage, theft, or misreporting before it impacts margins.

- Regulatory Compliance Assurance: Pre-configured compliance modules for regional requirements in Kenya, Malaysia, and Indonesia.

- Operational Efficiency: Faster approvals, reduced downtime, and streamlined fuel dispatch.

- Proven ROI: Companies have achieved up to 25% reduction in terminal losses within the first quarter of implementation.

By working with ROCKEYE, your business can eliminate compliance as an afterthought and make it a strategic asset, turning regulatory adherence into measurable operational gains.

Implementing Fuel Network Compliance Reporting: Best Practices

- Map Your Supply Chain: Understand every fuel movement point and compliance touchpoint.

- Digitize Documentation: Replace manual logbooks with integrated digital reporting.

- Monitor in Real-time: Use automated alerts to flag irregularities and prevent leaks.

- Audit Regularly: Conduct internal audits using compliance reporting dashboards.

- Review and Update Policies: Align internal policies with evolving regional fuel network regulatory requirements.

Fuel logistics compliance management, when approached strategically, protects both revenue and reputation.

Conclusion

In high-risk fuel networks, compliance reporting cannot remain a back-office afterthought. Operational risks, financial leakage, and regulatory penalties are real threats to businesses in Kenya, Malaysia, and Indonesia. By embracing automated compliance solutions, risk management tools, and standardized processes, fuel companies can turn compliance into a strategic advantage rather than a reporting burden.

With ROCKEYE’s fuel compliance management software, companies can achieve real-time visibility, safeguard margins, and ensure regulatory adherence, making compliance a key driver of operational excellence and profitability.

Book a commercial control demo with ROCKEYE today to start transforming your fuel network compliance from an afterthought into a measurable competitive advantage.

Frequently Asked Questions

Why is compliance critical in high-risk fuel networks?

Compliance is critical in high-risk fuel networks because it directly protects revenue, operating licenses, and business continuity. Fuel operations involve regulated products, high transaction volumes, and complex logistics, making them vulnerable to theft, leakage, and reporting errors. Without strong compliance controls, small inaccuracies can quickly translate into significant financial losses, regulatory penalties, and audit failures. Effective compliance ensures that every fuel movement, transaction, and inventory position is traceable, verifiable, and aligned with regulatory requirements.

What are the biggest compliance risks in fuel distribution?

The biggest compliance risks in fuel distribution arise from weak visibility and manual controls across the supply chain. Common risks include inventory shrinkage between terminals and stations, unauthorized dispatch overrides, inconsistent pricing and tax application, delayed or inaccurate regulatory reporting, and data mismatches between operations and finance. These risks are amplified in multi-location fuel networks where disconnected systems and manual processes make it difficult to detect non-compliance in real time.

How do fuel companies manage regulatory compliance?

Fuel companies manage regulatory compliance by combining automated reporting, standardized operating procedures, and continuous monitoring. Leading operators use fuel compliance management software to track inventory, sales, and dispatch in real time while generating audit-ready regulatory reports automatically. Compliance is further strengthened through predefined approval workflows, exception alerts, and centralized governance, ensuring that regulatory requirements are enforced consistently across terminals, depots, and retail networks.

What regulations apply to fuel supply chains?

Fuel supply chains are governed by strict national and regional regulations covering fuel movement, storage, pricing, taxation, and reporting. In Kenya, the Energy and Petroleum Regulatory Authority mandates detailed reporting on fuel imports, distribution, and stock reconciliation. In Malaysia, the Ministry of Domestic Trade and Consumer Affairs enforces documentation, pricing controls, and audit compliance. In Indonesia, fuel operations are regulated through Pertamina and regional energy authorities, requiring accurate, timely, and traceable reporting across the supply chain.

How do compliance failures impact fuel operations?

Compliance failures have immediate and long-term impacts on fuel operations. Financially, they lead to revenue leakage, unaccounted losses, penalties, and higher audit costs. Operationally, they cause dispatch delays, supply disruptions, and loss of control over inventory and pricing. Strategically, repeated compliance failures expose fuel companies to license suspension, reputational damage, and reduced confidence from regulators, partners, and investors, directly affecting business growth and profitability.

What is high-risk fuel network management?

High-risk fuel network management is the disciplined approach to controlling, monitoring, and governing fuel operations in environments prone to leakage, theft, and regulatory scrutiny. It involves real-time visibility of fuel movement, automated compliance reporting, strict approval controls, and proactive risk detection. The goal is to eliminate blind spots across terminals, logistics, and retail networks while ensuring full regulatory compliance, financial accuracy, and operational discipline.

How to improve compliance reporting in fuel networks?

Compliance reporting in fuel networks can be improved by replacing manual, fragmented processes with automated, system-driven controls. This includes implementing fuel compliance management software, enabling real-time inventory and transaction tracking, standardizing reporting formats across all locations, and enforcing approval workflows for high-risk actions such as dispatch overrides. Continuous monitoring, exception alerts, and audit-ready reporting ensure compliance is maintained proactively rather than corrected after failures occur.