Margin erosion rarely announces itself. For most leadership teams, it appears gradually through unexplained profit decline, tighter contribution margins, and growing pressure on working capital. Sales volumes may remain consistent. Demand may even increase. Yet profitability weakens quarter after quarter.

This silent decline is often driven by shrinkage that operates beneath the surface of daily operations. Unlike visible losses, shrinkage spreads quietly through inventory records, reconciliation gaps, pricing deviations, and delayed financial controls. Over time, this invisible drain becomes one of the most persistent causes of profit margin erosion.

For C-suite decision makers, shrinkage is not an operational inconvenience. It is a governance risk with direct financial consequences.

Must read: Boost Fuel Retail Margins by 15–25% with Integrated Downstream Commercial Control

What Is Shrinkage in Business and Why Leaders Miss It

To address the issue effectively, leaders must clearly understand what shrinkage in business is. Shrinkage refers to the gap between what the system believes should exist and what actually exists in physical inventory or realized revenue.

The retail shrinkage definition historically focused on theft or shop floor losses. In modern multi-location enterprises, shrinkage is far broader and far more complex. It emerges from administrative errors, uncontrolled transactions, weak reconciliation discipline, and fragmented systems.

Shrinkage often goes unnoticed because it does not appear as a single large loss. It hides within thousands of small variances that appear manageable in isolation but damaging in total.

Also read: Instant Tax & Regulatory Compliance: How Commercial Control Systems Automate Fuel Retail Reporting

How Inventory Shrinkage Quietly Accumulates

Inventory shrinkage grows when operational controls fail to keep pace with transaction volume. As businesses scale, manual processes and delayed oversight create gaps that allow value to leak unnoticed.

Shrinkage commonly enters through:

- Delayed inventory updates across locations

- Manual adjustments without approval controls

- Pricing mismatches between contracts and execution

- Infrequent inventory reconciliation

- Weak linkage between physical movement and financial posting

Each gap may seem minor. Together, create a systemic loss engine that steadily erodes margins.

Why Shrinkage Directly Drives Profit Margin Erosion

Shrinkage does not increase operating expenses directly. Instead, it silently reduces recoverable value. Inventory is consumed, moved, or sold without full financial capture. It makes shrinkage particularly dangerous because it bypasses traditional cost control frameworks.

When leadership teams conduct a profit leakage analysis, shrinkage often emerges as a key contributor. It explains why margins decline even when procurement, pricing, and sales strategies appear sound.

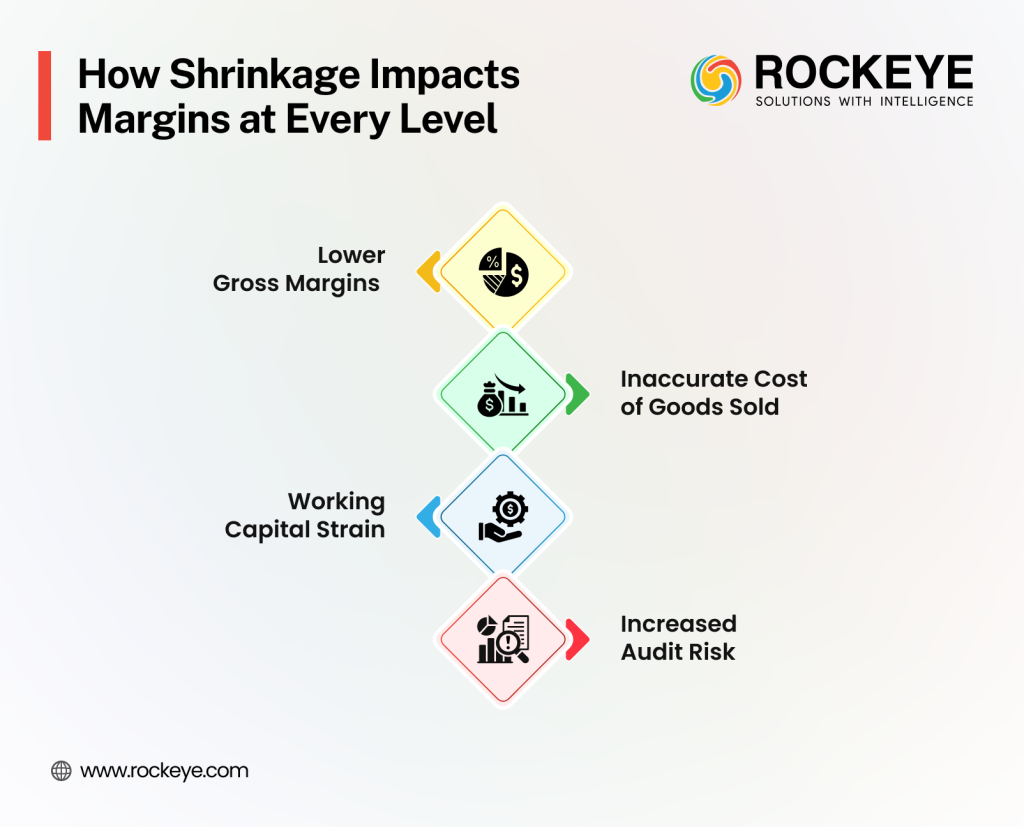

Unchecked shrinkage leads to:

- Lower gross margins despite stable revenue

- Inaccurate cost of goods sold

- Working capital strain from missing stock

- Increased audit exposure and adjustments

The longer the shrinkage remains unaddressed, the harder it becomes to reverse margin decline.

The Limits of Periodic Measurement

Many organizations attempt to calculate inventory shrinkage only during audits or annual stock counts. While this satisfies compliance requirements, it does little to prevent loss.

An inventory shrinkage calculator provides value only when data is timely, accurate, and continuously reconciled. When calculations rely on outdated or manually corrected data, shrinkage becomes a reporting metric rather than a control signal.

Effective shrinkage management requires visibility at the moment loss occurs, not months later during financial reviews.

Why ERP Systems Alone Cannot Stop Shrinkage

ERP Systems play a critical role in recording transactions and managing enterprise workflows. However, they are not designed to enforce commercial discipline at the transaction level. ERPs answer the question of what happened. They do not prevent what should not have happened.

This is why organizations with mature ERP Systems still struggle to reduce shrinkage in retail, industrial, and distribution environments. Shrinkage persists because no system actively governs pricing, quantity, and reconciliation in real time.

Preventing shrinkage requires an industrial & manufacturing digital control system layer that sits above transactional recording and enforces commercial rules consistently.

Commercial Control Systems as a Margin Protection Layer

A Downstream commercial control system introduces governance where operational complexity is highest. It ensures that inventory movement, pricing execution, and reconciliation remain aligned across terminals, depots, and distribution points.

Similarly, an Industrial commercial control system protects margins in manufacturing environments by aligning production output, material consumption, and inventory valuation with financial expectations.

These systems do not replace ERP Systems. They strengthen them by enforcing accountability, visibility, and control across every transaction.

Inventory Shrinkage Prevention Through Continuous Reconciliation

Inventory shrinkage prevention depends on how frequently and accurately variances are identified. Best performing organizations move away from periodic checks and adopt continuous reconciliation as a standard practice.

Inventory reconciliation best practices include:

- Daily or real-time reconciliation across locations

- Automated variance detection and alerts

- Clear ownership for variance resolution

- Immediate corrective workflows instead of end-of-period adjustments

This approach transforms shrinkage from a hidden financial drain into a visible operational signal that leadership can act on.

Why Reducing Shrinkage Is a Leadership Issue

Shrinkage is often delegated to audit or operations teams. It limits its impact. Silent shrinkage is a strategic risk that requires executive ownership.

When leadership treats shrinkage as a board-level priority, controls become embedded rather than optional. Data accuracy improves. Accountability strengthens. Margins stabilize.

Organizations that successfully reduce shrinkage in retail, industrial, or distribution operations do so because leadership demands commercial control, not just compliance.

Turning Shrinkage Control Into Sustainable Advantage

Businesses that master shrinkage control gain more than cost savings. They gain confidence in their numbers.

- Accurate inventory improves pricing decisions

- Reliable reconciliation strengthens audit readiness

- Controlled transactions protect margins consistently

- Clear visibility enables faster executive decisions

In margin-sensitive markets, this level of control becomes a competitive advantage.

Final Perspective for Decision Makers

Shrinkage is rarely dramatic. It is repetitive, quiet, and persistent. That is what makes it dangerous.

Organizations that ignore silent shrinkage unknowingly accept margin loss as a cost of doing business. Those that address it through commercial control frameworks protect profitability at the source.

For leaders focused on sustainable growth, shrinkage prevention is not an operational improvement. It is a strategic imperative.

Frequently Asked Questions

What is inventory shrinkage, and why does it matter financially

Inventory shrinkage is the difference between recorded inventory and the actual available stock. It matters financially because missing or miscounted inventory represents unrecovered costs that directly reduce profit margins.

How can organizations calculate inventory shrinkage accurately?

To calculate inventory shrinkage accurately, businesses must compare expected inventory based on purchases and sales with physical stock through frequent reconciliation and reliable data capture.

What is the modern retail shrinkage definition?

The retail shrinkage definition today includes theft, administrative errors, pricing inconsistencies, reconciliation delays, and system gaps that cause inventory or revenue loss.

How can companies reduce shrinkage in retail and distribution?

To reduce shrinkage in retail and distribution, companies must automate inventory tracking, enforce pricing controls, adopt continuous reconciliation, and assign clear accountability.

What are inventory reconciliation best practices?

Inventory reconciliation best practices include daily reconciliation, automated variance alerts, integrated operational data, and immediate corrective action rather than periodic reviews.

How does profit leakage analysis help control shrinkage?

Profit leakage analysis identifies gaps between expected and actual margins, revealing hidden losses caused by shrinkage rather than market conditions.

Why ERP Systems alone are not enough to prevent shrinkage?

ERP Systems record transactions but do not enforce commercial rules. Without a commercial control layer, shrinkage caused by operational deviations remains unchecked.