Imagine your finance team buried in spreadsheets, struggling with late reconciliations and manual entries. It is a reality for many small and medium enterprises. According to PCMag and the U.S. Business Bureau Index, 20% of SMEs without accounting software fail within their first year due to cash flow mismanagement, poor record-keeping, and compliance challenges. While 64% of small business owners have adopted financial accounting software, the remaining 36% remain exposed to inefficiencies and risks. Often, the real barrier is not reluctance but the lack of a clear plan for a smooth transition. This blog provides a complete guide to successfully moving from manual processes to smart, AI-powered accounting.

The Limitations of Manual & Legacy Accounting

While manual bookkeeping and legacy accounting systems were once the backbone of finance operations, they are increasingly becoming a liability in today’s fast-paced business environment. Many SMEs still rely on spreadsheets, disconnected modules, and paper-based workflows, exposing themselves to inefficiencies, errors, and compliance risks.

The consequences are significant: wasted time, flawed reporting, poor decision-making, and higher operational costs. Let us explore the key limitations of manual and legacy accounting.

Error Rates, Audit Risks, and Time Wasted

Manual bookkeeping is highly error-prone. In fact, 73% of SMEs report frequent data entry errors, and 58% struggle with calculation inaccuracies. These errors not only create audit challenges but also require repetitive rework, consuming valuable time.

Fragmented Systems and Siloed Data

Many SMEs operate with multiple ledgers and disconnected modules, creating isolated silos of financial data. This fragmentation makes it difficult to reconcile accounts, track transactions, or maintain consistency across departments.

Lack of Real-time Visibility and Decision Lag

Without an integrated, real-time accounting system, businesses struggle to get timely insights. Approximately 61% of SMEs admit to poor decision-making due to outdated or unreliable financial records.

Difficulty in Compliance, Multi-currency, and Tax Changes

Legacy accounting methods make it complex to stay compliant with evolving tax rules and multi-currency regulations. Inconsistent bookkeeping practices mean 57% of SMEs fail to align their reports with tax requirements, raising the risk of audits, penalties, and reputational damage.

Costs: People Overhead, Rework, and Lost Insights

Maintaining manual processes is costly. Beyond labor overhead, organizations face hidden costs from repetitive rework, delayed approvals, and lost insights that could drive smarter financial planning.

Key Capabilities of a Modern, AI-powered Financial Accounting Solution

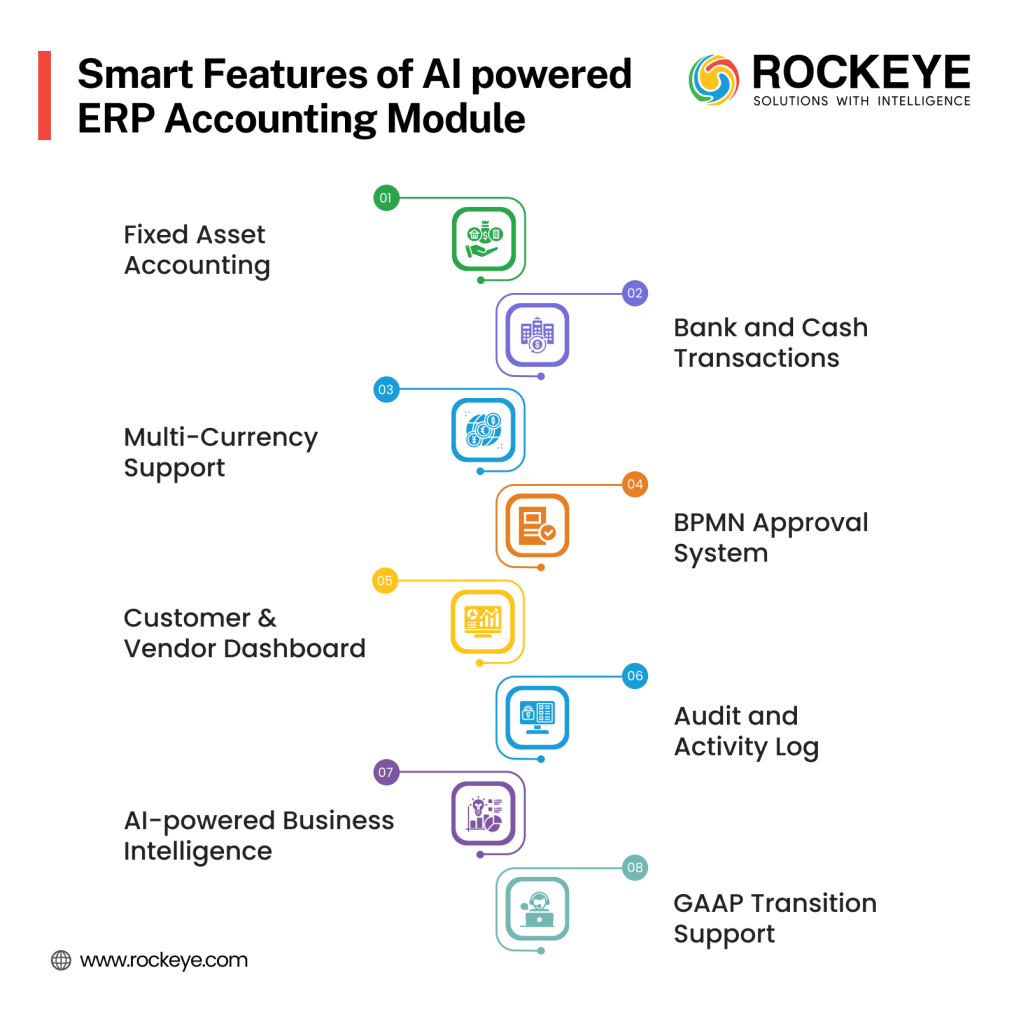

Modern ERP accounting software is designed to go beyond bookkeeping, combining automation, AI, and strategic insights to empower finance teams. Here are the core capabilities that define a smart accounting solution:

General Ledger and Fund Allocation

Real-time posting, rule-based fund allocation, and automated reconciliations ensure accurate and timely financial records, reducing errors and manual effort.

Accounts Receivable and Payable Streamlining

Accounts receivable and payable processes are automated, with invoice scanning, workflow approvals, and auto-matching, speeding collections, vendor payments, and cash flow visibility.

Fixed Asset Accounting

Track assets throughout their lifecycle with automated depreciation schedules and reporting, ensuring compliance and transparency.

Bank and Cash Transactions

Integrated bank and cash management allows real-time transaction tracking, liquidity monitoring, and seamless reconciliation.

Multi-currency Support

Handle multi-entity and multi-currency transactions effortlessly, maintaining compliance and consistent reporting across regions.

BPMN Approval System

Customizable business process management workflows enforce approvals, reduce bottlenecks, and ensure governance across finance operations.

Customer and Vendor Dashboards

Interactive dashboards provide real-time visibility into customer balances, vendor obligations, and outstanding transactions, improving decision-making and relationship management.

Audit and Activity Log

Comprehensive audit trails and activity logs track every transaction, supporting compliance, internal controls, and audit readiness.

AI-powered Business Intelligence and Strategic Consolidation

Advanced AI analytics provide predictive insights, trend detection, and scenario modeling, enabling informed decision-making and strategic consolidation across entities.

Tailored GAAP Transition Support

Industry-specific guidance ensures smooth compliance with accounting standards, facilitating accurate reporting and regulatory adherence.

Architecture and Integration Strategy

Designing a modern financial accounting software requires careful consideration of architecture, integration, and data management to ensure scalability, performance, and security:

- Architecture Approach: Choose between monolithic, modular, or microservices based on scalability, flexibility, and deployment needs.

- ERP Integration: Decide whether accounting is embedded in the ERP core or operates as a standalone module for easier upgrades.

- Data Model: Use shared master data and standardized reference tables to maintain consistency across modules.

- Integration Points: Seamlessly connect with procurement, inventory, sales, HR/payroll, and fixed assets.

- API & Event-driven Design: Leverage webhooks and message buses for real-time synchronization.

- Data Migration: Address legacy cleanup, mapping, and validation challenges.

- Security & Governance: Implement role-based access, encryption, and segregation to protect sensitive financial data.

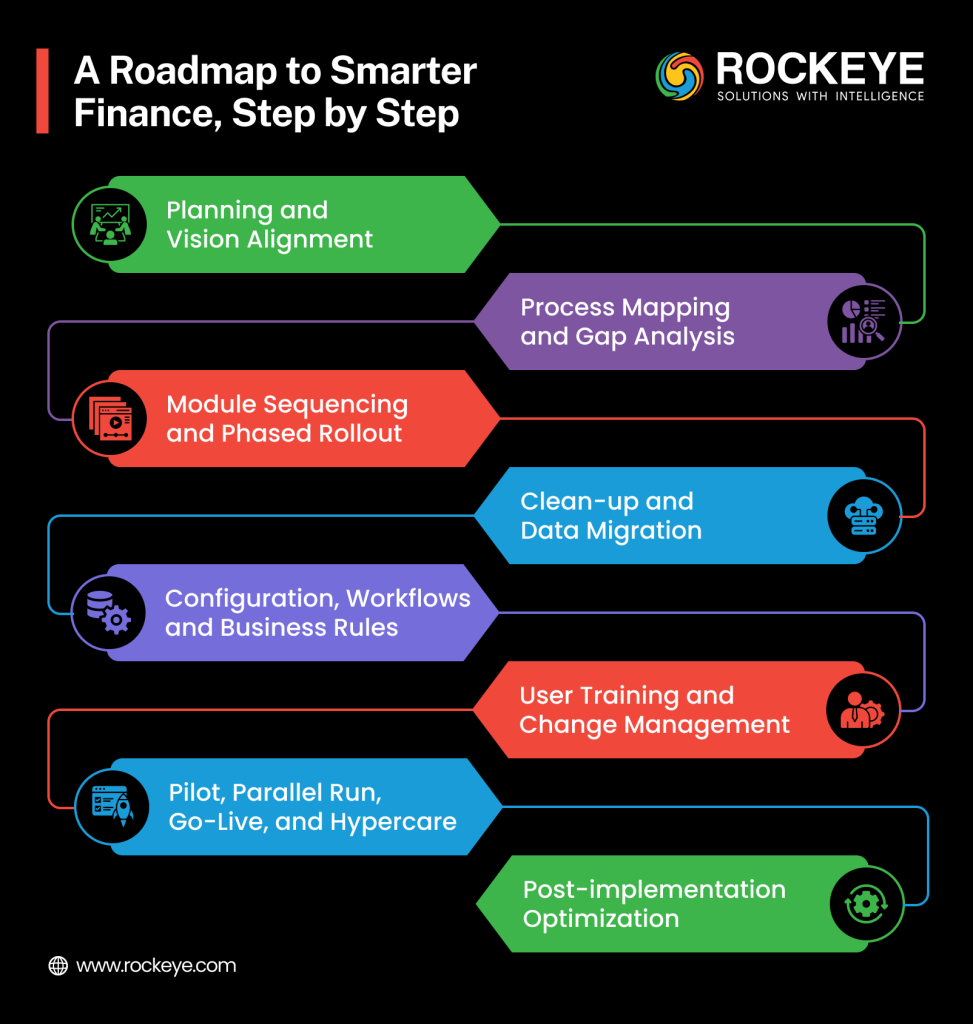

The Transition and Implementation Roadmap – From Manual to Smart

Successfully moving from manual or legacy accounting to a modern, AI-powered ERP accounting software requires a structured, phased approach. A well-defined roadmap ensures minimal disruption, optimal adoption, and measurable business value.

Step-1: Planning and Vision Alignment

Start by aligning stakeholders around a clear vision. Define goals, key performance indicators, and success metrics. Involve finance, operations, IT, and management teams early to ensure the transition addresses operational efficiency and strategic business objectives.

Step-2: Process Mapping and Gap Analysis

Assess current workflows and systems to identify inefficiencies and compliance gaps. Compare the existing processes versus the target state, highlighting redundancies, manual interventions, and bottlenecks. It forms the foundation for designing functional and technical requirements.

Step-3: Module Sequencing and Phased Rollout

Not all modules need to go live simultaneously. Prioritize high-impact modules like accounts payable, receivable, and general ledger first. Subsequent phases can include budgeting, forecasting, or multi-entity consolidations, allowing teams to adapt gradually and mitigate risk.

Step-4: Clean-up and Data Migration

Prepare legacy data by standardizing, validating, and mapping it to the new system. Reconcile balances and ensure compliance with accounting standards. Data quality is crucial, as inaccurate inputs can compromise automation and AI-driven insights.

Step-5: Configuration, Workflows, and Business Rules

Configure the system to reflect organizational policies, approval hierarchies, and regulatory requirements. Implement BPMN-based approval workflows, automated reconciliations, and fund allocation rules for accuracy, control, and compliance across multi-entity and multi-currency operations.

Step-6: User Training and Change Management

Adoption is key. Conduct role-based training, workshops, and ongoing support. Implement a change management plan to address resistance and process shifts, ensuring teams embrace automation rather than circumvent it.

Step-7: Pilot, Parallel Run, Go-live, and Hypercare

Validate processes, integrations, and system performance through pilot runs or parallel testing. During go-live, provide hypercare support to resolve issues rapidly, stabilize operations, and optimize configurations.

Step-8: Post-implementation Optimization

Continuously monitor KPIs, audit logs, and workflows. Use AI insights to refine processes, improve forecasting accuracy, and enhance compliance. Continuous improvement ensures the system evolves with business needs.

Why is ROCKEYE ERP’s Financial Accounting Module a Smart Choice for Your Business?

Choosing the right ERP accounting software can transform your business. ROCKEYE ERP’s AI-powered accounting ERP system stands out for its seamless integration, automation, and strategic insights.

Here’s why it is the preferred choice:

- Complete ERP Integration: Works effortlessly with inventory, procurement, HR, sales, and fixed asset modules, ensuring end-to-end process visibility.

- AI-enhanced Analytics: Unlock real-time insights with predictive dashboards, anomaly detection, and actionable KPIs for smarter decision-making.

- Automation and Accuracy: Minimize manual errors with automated AR/AP processing, fund allocation, and reconciliations, reducing closing cycles and improving compliance.

- Scalable and Multi-entity Ready: Supports multi-currency, multi-entity operations, and complex reporting needs as your business grows.

- Robust Security and Governance: Built-in audit trails, role-based access, and activity logs ensure transparency, regulatory compliance, and data protection.

- Phased, Low-disruption Adoption: Modular rollout allows smooth transition with minimal operational interruption, making it ideal for both SMEs and large enterprises.

- Tailored Business Insights: AI-driven strategic consolidation and analytics help you anticipate cash flow, optimize budgets, and plan confidently.

With these capabilities, ROCKEYE ERP’s financial accounting module empowers businesses to operate smarter, faster, and with full confidence, delivering efficiency, accuracy, and strategic advantage in today’s competitive landscape.

Conclusion

Transitioning from manual record-keeping to a modern, AI-powered financial accounting software is no longer optional; it is strategic. By embracing automation, real-time insights, and integrated workflows, businesses can reduce errors, enhance compliance, and make faster, smarter decisions. A structured implementation ensures minimal disruption while unlocking long-term efficiency, scalability, and competitive advantage in financial management.

FAQs

1. Why should I choose ROCKEYE ERP’s accounting solution over a standalone system?

ROCKEYE ERP offers end-to-end integration across procurement, inventory, HR, and sales. Unlike standalone tools, it provides real-time insights, automated workflows, and consolidated reporting, giving a complete view of your business finances.

2. What role does AI play in modern ERP finance modules?

AI enhances accuracy and decision-making. It predicts cash flow trends, flags anomalies, automates allocations, and provides scenario-based forecasting, helping finance teams act proactively instead of reactively.

3. Can ERP accounting modules be customized for different industries?

Yes. The system supports industry-specific configurations, compliance rules, and reporting standards, ensuring that workflows and analytics are tailored to your sector.

4. How does the system handle multi-entity or multi-currency operations?

It allows seamless multi-entity consolidation, real-time currency conversions, and cross-border compliance, making it ideal for growing SMEs and businesses operating internationally.

5. What about security and compliance?

ROCKEYE ERP comes with role-based access, detailed audit trails, and encrypted data handling, ensuring regulatory compliance, internal control, and protection of sensitive financial information.