The Margin Reality Facing Downstream Oil Companies Today!

Across Kenya, Indonesia, and Malaysia, downstream oil and gas companies operate in a margin environment defined by volatility, regulation, and execution risk.

While crude benchmarks and freight costs dominate boardroom discussions, the real threat to profitability lies elsewhere: uncontrolled pricing execution, delayed margin visibility, and fragmented commercial systems.

For C-suite leaders, pricing is no longer a commercial decision alone. It is a governance challenge with direct P&L impact.

Why Traditional Pricing Models Are Failing Downstream Operations

Fragmentation Between Commercial Intent and Execution

Most downstream organizations still operate pricing through disconnected systems and manual coordination. Trading teams manage supply positions using the oil and gas downstream suite.

Commercial teams calculate prices in spreadsheets. Operations execute dispatch using oil and gas supply chain software. Finance reconciles outcomes inside oil and gas ERP systems.

This system architecture was never designed to actively protect margins at the point of execution. It records transactions after they occur but offers no control at the moment value is created.

As a result, pricing leakage rarely occurs due to a flawed strategy; it occurs due to uncontrolled execution. It happens because execution is uncontrolled.

The Hidden Cost of Manual Pricing Environments

In manual or semi-automated environments, pricing governance weakens at scale. Approved prices are overridden at terminals. Dealer discounts drift beyond policy limits. Cost components lag behind market reality. Margin reconciliation becomes a forensic, time-consuming exercise that delivers insights too late to recover lost margin rather than a control mechanism.

By the time finance identifies margin variance, the opportunity to intervene has already passed.

What Defines a Next-generation Commercial System

Beyond ERP: From Record-keeping to Commercial Control

Next-generation commercial control systems are not incremental upgrades to legacy oil and gas software. They represent a structural shift in how pricing and margins are governed.

Unlike traditional oil and gas ERP systems, these platforms:

- Enforce pricing logic at the point of execution.

- Embed approvals, controls, and compliance into transactions.

- Continuously validate margins before revenue is realized.

Within ROCKEYE’s Downstream Commercial Control System (DCCS), pricing is treated as a controlled economic process, not a static master data entry.

Automating Pricing Strategy Across Downstream Operations

Centralized Pricing Intelligence

Next-generation commercial systems centralize pricing logic using live inputs such as:

- International crude and product benchmarks.

- Landed cost and logistics tariffs.

- Dealer margins and contractual terms.

- Tax structures and regulatory pricing rules.

- Foreign exchange exposure.

Controlled Pricing Execution

Once prices are approved:

- Pricing flows automatically into sales, dispatch, and invoicing.

- Manual overrides are restricted or audited.

- Every transaction executes against approved commercial rules.

This level of oil and gas automation ensures that pricing intent and execution remain aligned across terminals, depots, bulk sales, and retail networks.

Must Read: 7 Essential Features of Modern Terminal Management Systems in Oil and Gas

Real-time Margin Control as a Governance Function

Why Post-facto Margin Reporting Is No Longer Enough

Margin erosion in downstream oil and gas operations rarely occurs as a single event; it accumulates through repeated, often unnoticed deviations. Next-generation commercial systems shift margin control from reporting to prevention

How Real-time Margin Governance Works

- Transactions are validated against expected margin thresholds.

- Unauthorized discounts trigger alerts or transaction blocks.

- Cost variances are captured immediately, not at month-end.

- Margin exposure is visible by product, outlet, route, and customer.

This approach transforms margin protection into an operational discipline rather than a finance cleanup exercise.

The Role of AI and Advanced Analytics in Pricing Automation

Moving from Reactive to Predictive Pricing

Artificial intelligence plays a critical role in modern oil and gas digital transformation initiatives.

AI and machine learning enable:

- Analysis of historical pricing and margin performance.

- Identification of demand elasticity by region and channel.

- Detection of abnormal discounting or margin leakage patterns.

Scenario Modeling for Volatile Markets

When integrated with energy trading and risk management software, AI enables scenario simulations such as:

- Benchmark price volatility impact.

- Currency fluctuation exposure.

- Logistics disruption and cost escalation.

It allows leadership teams to make informed pricing decisions before market volatility erodes margins.

Integrating Trading, Pricing, and ERP for Commercial Alignment

Eliminating the Commercial-to-finance Gap

One of the most powerful capabilities of next-generation commercial systems is deep integration across:

- Oil and gas trading software.

- Pricing engines and approval workflows.

- Execution systems across supply chain operations.

Oil and gas ERP systems for financial posting and reporting.

Tangible CFO-level Outcomes

Implementing a unified commercial control framework converts complex operational data into actionable financial intelligence and long-term fiscal stability.

- Real-time gross margin visibility.

- Faster financial close cycles.

- Stronger audit trails and compliance posture.

- Reduced reconciliation effort and manual adjustments.

Profitability becomes measurable, traceable, and defensible.

Managing Price Volatility in Global Energy Markets

Why Volatility Breaks Manual Pricing Models

Manual pricing models are slow, reactive, and inconsistent. In volatile energy markets, this exposes companies to margin shocks and compliance risk.

How Next-gen Commercial Systems Absorb Volatility

- Dynamic pricing rules adjust within approved risk limits.

- Hedging impacts are reflected directly in margin calculations.

- Exposure dashboards provide leadership with live risk visibility.

It ensures pricing agility without sacrificing governance or control.

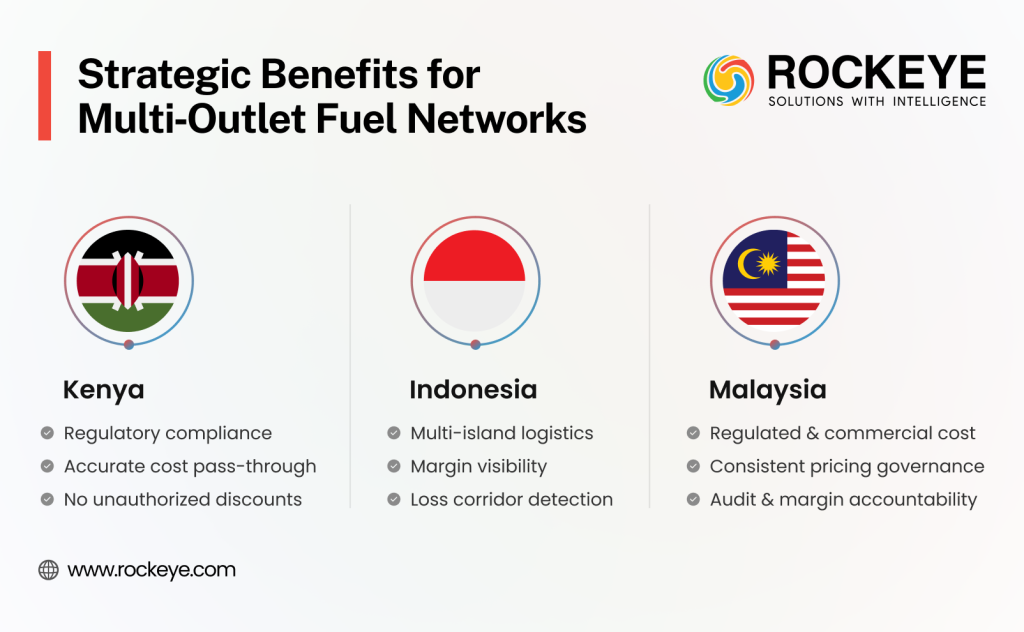

Regional Impact: Kenya, Indonesia, and Malaysia

Kenya

- Tight regulatory oversight and controlled pricing structures.

- Automated pricing ensures accurate cost pass-through.

- Unauthorized discounts and execution leakage are eliminated.

Indonesia

- Complex multi-island logistics and distribution networks.

- Real-time margin visibility by route and region.

- Early identification of loss-making supply corridors.

Malaysia

- Coexistence of regulated and commercial pricing environments.

- Consistent pricing governance across business segments.

- Strong audit readiness and margin accountability.

Why Leading Oil Companies Are Moving Beyond Traditional Systems

Traditional ERP-led digital platforms for oil and gas were designed to record transactions, not govern them.

Next-generation commercial systems exist to answer a different question: Are we protecting the margin at the moment revenue is created?

For leading downstream operators, the shift is clear. Margin protection requires active control, not retrospective reporting.

Also Read: How AI-Powered TMS Transforms Oil and Gas Logistics?

Conclusion: Pricing Automation Is Now a Board-Level Imperative

In downstream oil and gas operations, pricing and margin control are no longer tactical functions. They are strategic levers of profitability, compliance, and shareholder confidence.

Next-generation commercial systems enable oil companies to:

- Automate pricing strategy execution.

- Enforce margin discipline in real time.

- Govern commercial risk across volatile markets.

For organizations operating in Kenya, Indonesia, and Malaysia, this is not a technology upgrade. It is a commercial transformation.

Frequently Asked Questions

1. What are next-generation commercial systems in the oil and gas industry?

Next-generation commercial systems are advanced platforms designed to automate pricing, enforce margin control, and govern commercial execution across downstream oil and gas operations. They go beyond traditional oil and gas ERP systems by preventing revenue leakage in real time.

2. How does pricing automation improve margin control for oil companies?

Pricing automation ensures that approved pricing rules are executed consistently across all sales channels. It eliminates manual errors, unauthorized discounts, and delayed cost updates, protecting margins before transactions are completed.

3. What technologies are used for real-time fuel pricing and margin optimization?

Real-time pricing relies on integrated oil and gas software solutions, AI-powered analytics, pricing engines, energy trading and risk management software, and seamless integration with oil and gas supply chain software and ERP platforms.

4. How do AI and machine learning impact pricing strategies in oil and gas?

AI and machine learning analyze historical performance, market volatility, and demand patterns to recommend optimal pricing strategies. They also detect anomalies in pricing execution and margin performance.

5. How do integrated trading, pricing, and ERP systems improve profitability?

Integration aligns trading positions, pricing decisions, execution workflows, and financial reporting. It improves margin accuracy, accelerates financial close, strengthens audit compliance, and enhances profitability visibility.