Why Governance, Not Capacity, Is Now the Real Competitive Advantage for Fuel Terminals

Malaysia’s downstream fuel distribution landscape is shifting fast. Margins are tightening, compliance pressure is rising, and dispatch complexity is increasing across multi-modal networks, road tanker fleets, marine movements, pipeline transfers, and multi-tenant depots.

In this new reality, the differentiator is no longer terminal size, fleet capacity, or storage volume.

It’s Terminal Dispatch Governance, the ability to control product movement, enforce compliance, eliminate leakage, and make every dispatch profitable.

And this governance can no longer be manual.

Forward-thinking Malaysian operators are modernizing around a unified, AI-powered Terminal Management System (TMS) that governs not just operations, but the entire dispatch value chain from gate-to-gate workflows to marine bunkering, customs reporting, inventory reconciliation, and ESG audits.

This is where real margin protection starts.

Why Terminal Dispatch Governance Matters More Than Ever

Global and local pressures are reshaping terminal economics:

- Rising enforcement from DOSH, DOE, Marine Department, Customs, and JPJ

- Increasing demand from energy companies for real-time traceability

- Growing audit failures due to documentation gaps

- Continued pilferage and “invisible leakage” in road tanker dispatch

- Manual processes that break governance and inflate operating costs

- Pressure to comply with ESG, digital records, and cybersecurity mandates

In high-volume oil terminal operations, even a 0.5% loss or a single governance lapse can erode annual margins significantly.

This is why Malaysian operators are shifting towards AI-enabled terminal operations management, where governance becomes automated, auditable, and data-driven.

How an AI-powered Terminal Management System Locks In Margin

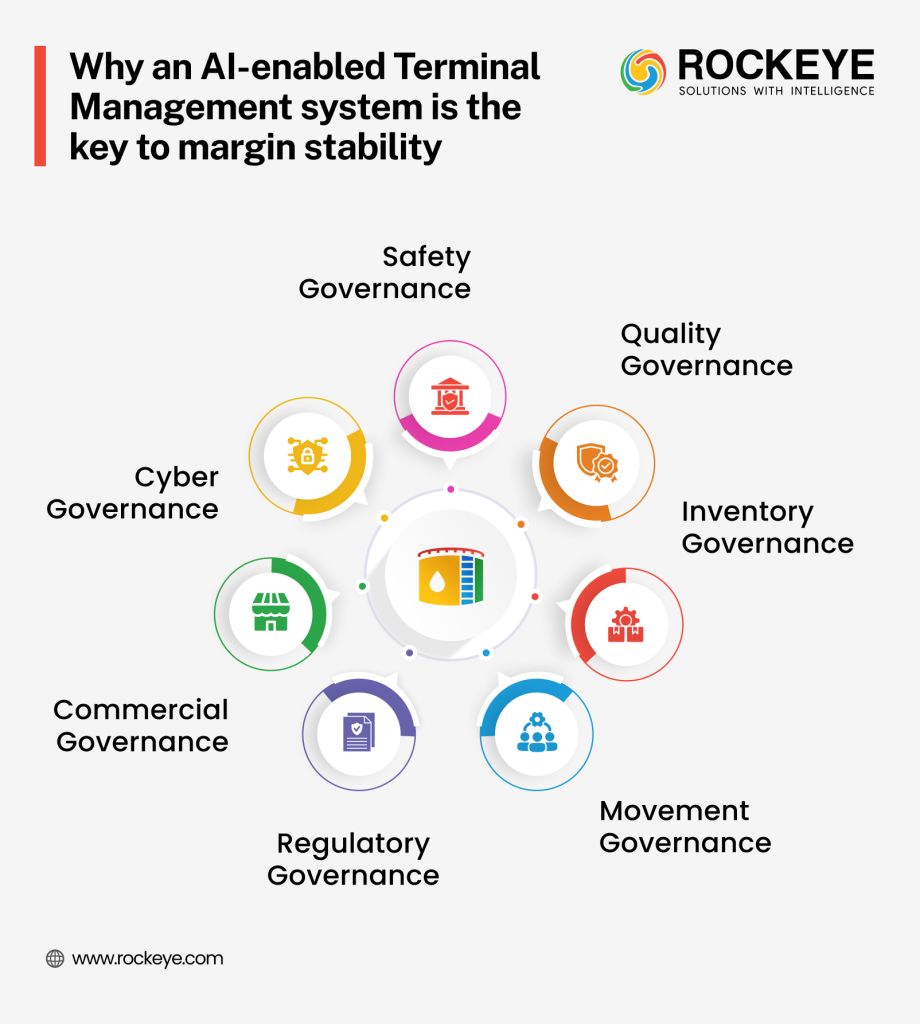

A modern TMS terminal management system goes far beyond planning or scheduling. It provides comprehensive Terminal Dispatch Governance across:

- Safety governance – PTS, work permits, safety checklists, PPE compliance

- Quality governance – product integrity, contamination control

- Inventory governance – tank dipping, auto-reconciliation, adulteration detection

- Movement governance – inbound/outbound tracking, loading arm validation

- Regulatory governance – automated compliance records, audit logs

- Commercial governance – pricing, customer limits, contract rules

- Cyber governance – authentication, access, network segmentation

In short:

Every litre, every truck, every transaction becomes accountable.

This reduces wastage, undocumented movements, manual errors, and fraud, delivering direct margin protection.

The Governance Gap in Malaysia’s Terminal Ecosystem

Across port and terminal operations, we see recurring gaps:

1. Fragmented Systems

CRM, ERP, weighbridge, access control, ATG, marine systems, and manual Excel logs rarely talk to each other.

2. Manual Approvals

Safety, gate passes, loading orders, and customs declarations are still dependent on human intervention.

3. Human-Driven Dispatch Decisions

Operators make quick decisions under pressure, leading to inconsistencies, misses, or bypasses.

4. Weak Auditability

Paper trails cannot pass DOE, DOSH, or Customs scrutiny.

5. Limited Visibility

Multi-location terminals lack a unified governance dashboard. These inefficiencies bleed margins daily.

The solution: Digitized Terminal Governance.

Also Read: Inbound Logistics Optimization in Malaysian Food Processing Plants

What Digital Governance Looks Like in Modern Terminal Operations

A digitally-governed terminal automates:

✔ Terminal access control

✔ Driver/Tanker authentication

✔ Loading authorisation

✔ Real-time inventory validation

✔ Auto-checks against customer quotas & credit

✔ Engine-off safety checks

✔ Dispatch sequencing

✔ Marine bunkering validation

✔ Customs documentation

✔ Multi-tenant revenue allocation

This creates a “trustless” governance layer, rules are fixed, automated, and applied consistently every single time.

The Impact on Margin Protection

Digitized governance drives measurable results:

| Governance Area | Improvement |

| Product loss reduction | 20–40% improvement |

| Dispatch turnaround time | 25–35% faster |

| Audit readiness | 100% real-time |

| Pilferage/fraud detection | Up to 90% reduction |

| Operational cost | 15–20% savings |

| Manual paperwork time | 60–80% reduction |

For CEOs and CFOs, this means:

Higher profit per dispatch + lower compliance risk = locked-in margin.

Why AI Is Becoming Central to Terminal Governance

AI adds a predictive and preventive governance layer:

- Detects anomalies in tanker movement

- Predicts product loss risk

- Flags non-compliant behaviours

- Identifies abnormal loading patterns

- Automates ESG reporting

- Predicts safety incidents before they happen

This moves governance from reactive to proactive.

Malaysia’s Multi-Tenant Terminals Need Stronger Governance

With third-party operators, multiple exporters, and complex contracts, the risk of leakage increases.

A centralized governance model ensures:

- Standardized rules

- Separate inventories

- Automated revenue allocation

- Customer-specific compliance flows

- Role-based access

- Full audit transparency

This model is quickly becoming the norm for modern Malaysian petroleum terminal operations.

Must Read: Downstream Supply Chain Control – real-time Visibility in Fuel Transport

Why ROCKEYE Is the Governance Platform of the Future

ROCKEYE is not just software; it’s a governance transformation layer that helps CEOs, CTOs, and CFOs unlock margin predictability in a volatile downstream market.

With ROCKEYE, Malaysian terminal operators get:

✔ Zero manual governance gaps

✔ Zero undocumented losses

✔ Zero tolerance for unsafe or non-compliant dispatches

✔ 100% audit readiness

✔ 360° visibility of all terminal operations

✔ Higher margins protected by data-driven control

In a market where every litre and every movement counts, ROCKEYE provides the digital governance foundation that Malaysian terminals need to scale safely, profitably, and compliantly into the future.

Final Thoughts: Governance Is the New Margin Strategy

Malaysia’s downstream commercial control system is entering a phase where every litre counts, and compliance pressure will only intensify. CEOs, CTOs, and CFOs who invest in AI-driven Terminal Dispatch Governance now will gain:

- Lower operational risk

- Stronger audit readines

- Reduced product losses

- Improved safety culture

- Higher ESG performance

- A consistent, predictable profit profile

In short:

A modern terminal management system is no longer an IT upgrade; it’s a margin-protection strategy for the next decade.

FAQ: Terminal Dispatch Governance in Malaysia

1. How do Malaysian fuel terminals implement end-to-end Terminal Management Governance to meet DOSH, DOE, and JPJ compliance standards?

By using a unified terminal management system that automates safety workflows (DOSH), environmental logs (DOE), and transporter records (JPJ). Every loading, movement, and incident is documented automatically for audit readiness.

2. What digital governance framework should Malaysian petroleum terminals follow to reduce operational risks and improve auditability?A framework based on ISO 55001, API 2350, and digital-by-default governance, supported by automated checklists, audit logs, and risk controls embedded inside the TMS.

3. How can AI improve safety governance and incident prevention?

AI analyzes patterns across dispatches, flags risky driver behaviour, predicts overfills, identifies equipment anomalies, and alerts operators before an unsafe event occurs.

4. How do Malaysian terminals ensure compliance with Bunkering & Customs regulations?

By digitizing bunkering authorizations, automating customs documentation, and integrating marine logs directly into the TMS for transparent, timestamped records.

5. What is the best governance model for managing multi-tenant fuel terminals?

A centralized digital governance model with role-based controls, automated billing, segregated ledgers, and standardized safety workflows across all tenants.